After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

The sector, whose capitalization exceeded $ 5 billion in 2015, continues to grow at a record pace.

Global investment in agri-food projects in recent years has demonstrated an average annual growth rate of about 50%.

The development of agricultural business is supported by general trends in the global economy, including the explosive growth in demand for bulk food produced on a large scale. Economic transformation and urbanization have contributed to the transfer of agriculture to new technologies, increased economic profitability of agricultural producers and improved organization of business.

Despite this, income growth in the agricultural sector continues to lag behind industry and other knowledge-intensive industries.

There is a clear need for further investment in the agri-food sector, especially in biotechnology.

Innovative startups play an important role in increasing agricultural productivity. Venture capital investment in these projects has grown from $ 300 million in 2010 to $ 5.2 billion in 2020, and continues to show strong growth in the wake of commercial success.

The high demands of Western countries and growing Asian markets contribute to the development of poultry farming, livestock farming, winemaking and other traditional areas of agriculture, along with completely new areas (for example, mass production of non-animal protein).

ESFC Investment Group has brought together a team of highly qualified specialists in the field of financial modeling, business law and engineering. Together with our international partners, we offer attractive long-term financing models for agricultural projects in Europe and beyond, including multimillion-dollar loans to grow your business from scratch.

Fundamentals of agricultural business financing / lending

For centuries, food production has been the most important goal of agriculture.This goal is determined by the development strategies of the agri-food sector, which has evolved from the model of small peasant farms to the model of large agricultural holdings with huge assets and dozens of controlled companies.

Agriculture at all times has been the main source of income and the most important place of work for people in rural areas. The growth of production mechanization and market mechanisms changed the situation.

The rapid increase in agricultural production, along with the development of other industries, gradually led to the displacement of this sector to the periphery of economic life.

The agricultural production process is in dire need of external financing, including international loans and sector subsidies at the national and international levels. The sector currently requires a significant inflow of funds to upgrade the technical base and increase the overall productivity of agriculture, especially in developing countries.

As part of its financial activities, an agricultural enterprise selects the most suitable sources of financing and capital structure, and also determines the conditions for repayment of debts to potential suppliers of capital. Investment decisions in the agricultural sector must be made with multiple risk factors and high uncertainties in mind. Participants in large investment projects should evaluate and take into account in their forecasts such factors as possible crop failure, climatic changes, decreased demand, fluctuations in the price of fertilizers, fuel and seeds.

Good financial decisions in this sector form the basis for effective investment projects. Increasing investment costs too quickly, without considering potential risks and financial constraints, can lead to a loss of financial liquidity, which means for some companies the path to bankruptcy.

Therefore, an agricultural enterprise should strive for sustainable, long-term development instead of achieving immediate effects at any cost. When planning investments in agricultural projects, one of the key problems is the rational choice of the capital structure to support the investment process.

Types of financing and capital structure

The financial resources required for the implementation of an agricultural project can come from various sources.Thus, financing of agribusiness consists in the correct choice of sources of funds and the formation of a capital portfolio with the most appropriate ratio of each of these sources in the overall financial structure of the project.

The modern financial literature, depending on the criteria used, offers several ways to finance large agricultural projects.

Among other things, the researchers distinguish classifications of sources of financing for investment activities based on the following criteria:

• Owner of financial resources.

• Sources of funds and their origin.

• Debt repayment terms.

• Term of financing, etc.

If we analyze the sources of capital, financing of agriculture can be carried out using external sources or by mobilizing internal financial resources of companies (agricultural holdings).

Practice shows that small farms in most cases do not trust debt instruments (due to the high risk of economic activity and peculiarities of the mentality), while agricultural holdings widely use debt financing.

The success of agricultural holdings is largely determined by access to internal and external sources of funding. This can be easily explained by the high investment needs of the agri-food business, the continuous process of changing the efficiency of agricultural production and continuous transformation of the business environment.

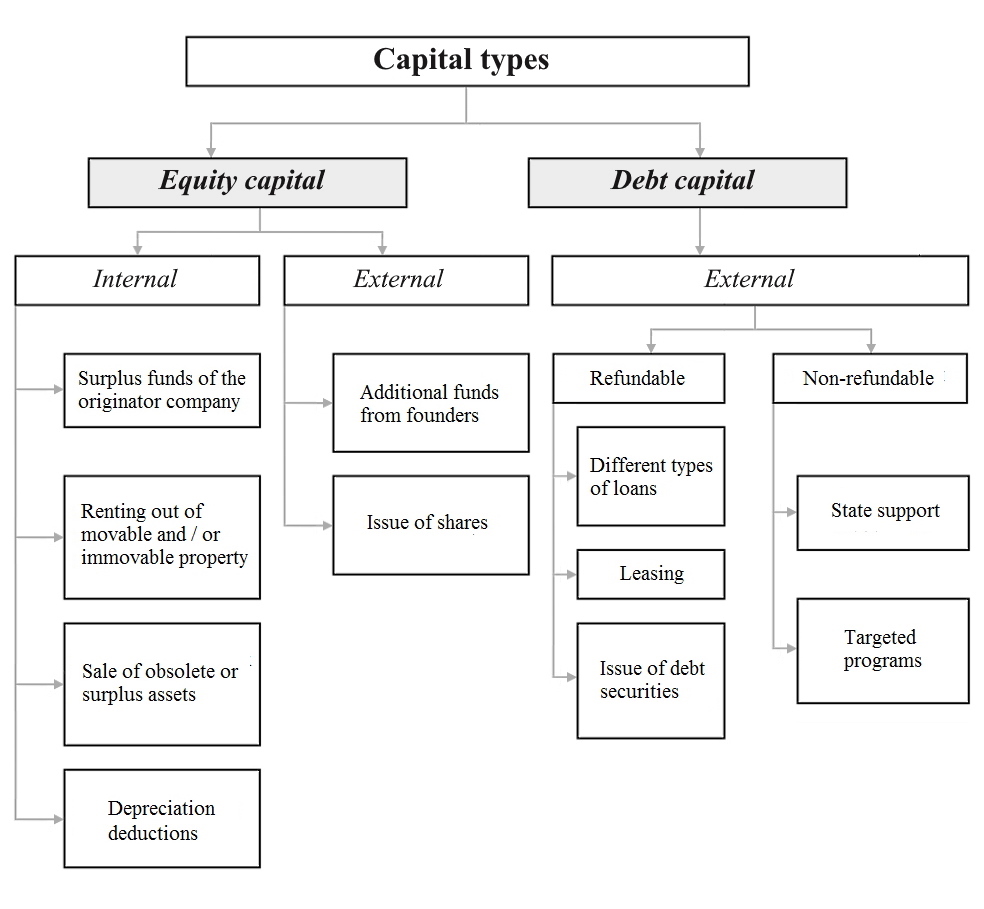

Equity capital is provided for the needs of the investment project by its owners.

Debt capital, in turn, is provided to the borrower by third parties for a specified period of time, with the debt usually having to be repaid in some form to the capital provider with some interest.

Equity capital is the most stable basis for financing agriculture, largely determining the maintenance of the financial liquidity of enterprises. In addition to domestic resources, which remain the main element of the farm capital structure, external sources of funds, including long-term loans and subsidies, also play an important role.

Figure: Types of capital for financing agricultural projects.

This classification is based on the distinction between the methods of involving capital in economic activity and the participation of each of the sources in the investment process.

Another important criterion for the classification of funding sources is the term of financing (debt repayment). Depending on the term, financing of agribusiness can be short-term, medium-term or long-term (maturity more than 1 year).

Sources of long-term financing involve the allocation of funds that are involved in the company's activities on a long-term or permanent basis.

These financial resources form the financial basis for any major project.

Short-term sources of financing provide the company with capital for less than 1 year. These funds play a secondary role in the implementation of investment projects, supporting the current activities of the agricultural enterprise.

Choosing funding sources

In a properly managed and efficient agricultural holding, internal financial resources should increase over time, covering a significant part of the company's investment needs.This is essential for maintaining financial balance and long-term growth.

But agriculture is becoming an increasingly complex, competitive and capital intensive industry. All of the above, along with the general trend towards the enlargement of agricultural enterprises and projects, requires external financing.

Effective agricultural production involves the attraction and use of external financing. This group includes: direct subsidies, loans / borrowings (bank, personal), leasing, refund of excise taxes, insurance payments in case of natural disasters, and so on.

The use of external resources makes it possible to improve financial results and increase income from core activities.

Despite the long list of funding sources, the main source of debt financing today is a bank loan.

In agriculture, loans (mainly concessional loans and overdrafts, which have been gaining popularity in recent years) usually supplement equity financing.

This business practice, which appears to be the most appropriate in a high-risk environment, contributes to higher incomes, a broader capital base and improved profitability in agricultural production.

The demand for agricultural loans depends on the phase of market development, the asset structure of companies in the sector and the quality of the economic infrastructure that surrounds the agriculture of a particular region.

As we mentioned above, the high propensity of farms to self-finance investment activities is a consequence of the high risk and hostility of most farmers to debt instruments. Given the limited ability of agricultural producers to accumulate liquid funds, insufficient information and high operational risk, leasing instruments become an attractive alternative to traditional financing.

The development of the leasing market in recent years is due to the obvious advantages of using this source for large agricultural projects.

These advantages include the following:

• Fast implementation of production modernization projects.

• Access to new technologies without having to bear the cost of purchasing them.

• Repayment of lease payments from the company's current cash flows.

An important aspect when making investment decisions is the adjustment of funding sources and capital structure in accordance with the planned life and cost of the investment project.

The longer the life of the enterprise and the more expensive an agricultural investment project, the more stable, cheap and long-term source of financing is needed.

The structure of funding sources for large agricultural projects is influenced by many factors. The most important of these factors are the cost of capital and the financial risk associated with the use of borrowed funds. According to the hierarchy of financing sources, agricultural enterprises first use internal resources, then attract external financing, preferring in the latter case long-term debt instruments without issue of shares.

The major ways of financing agricultural projects

The basis for financing the activities of agricultural enterprises is made up of direct and indirect instruments based on the use of various securities.

The choice of a method for financing current activities and attracting resources for capital-intensive projects is determined by the type and scale of the company, the specifics of a particular project, market conditions, interest rates and other factors.

Financial modeling plays an important role in developing a long-term business strategy.

It includes the professional development of the most appropriate financing mechanisms to minimize the cost of capital, reduce taxes and ensure sustainable growth.

ESFC Investment Group offers financing for large agricultural projects around the world. In particular, we assist in obtaining long-term bank loans for agricultural holdings from 50 million euros or more with a maturity of up to 20 years. Also, our team develops financial models taking into account the customer's requirements and the financial needs of a particular company.

Direct financing

The so-called direct financing is mainly used on a small scale, although the use of these instruments for large agricultural projects is also possible and in demand in a number of countries.These tools give producers direct access to inputs and inputs to agricultural production.

These are lucrative options for both borrowers (agricultural producers) and lenders (suppliers, processors, intermediaries and sellers). Today, many agricultural industries in the world are successfully developing on the basis of such agreements between market participants.

Financing from intermediaries

The essence of this financial instrument lies in the fact that intermediaries or sellers of agricultural products provide loans to the projects of producers.The latter undertake to repay the debt in the form of a supply of fresh agricultural products.

This simple and effective mechanism ensures that resellers receive sufficient quantities of products for their core business. On the other hand, farms and agricultural holdings provide guaranteed access to the necessary financing, while ensuring the sale of their products at a fixed price.

Funding from resource suppliers

This is the opposite situation, in which a supplier of resources (for example, fuel, fertilizers, seeds) fully or partially finances agricultural projects so that producers in the future will repay debts after the sale of the harvested crop.The cost of borrowed funds is included in the price of the product.

In this way, agricultural producers receive the necessary resources to expand production, and resource suppliers increase sales in the long term. This is a common financing scheme in agricultural areas that require expensive fertilizers and / or significant amounts of fuel.

The role of borrowed funds

The most common way to finance agricultural projects is through loans.Borrowed funds can be issued for a period of several months to several years (in the case of capital intensive expansion projects).

In recent years, lending has affected almost all areas of the rapidly growing agricultural business, from manufacturing and logistics to marketing.

Debt repayment can be carried out both in the form of cash and by the products of farms, which directly depends on the goals of the capital provider. Paying off debt with agricultural products, for example, allows creditors to guarantee the supplies necessary for the main business and fix purchase prices for a long period.

It is worth highlighting the growing role of large multinational corporations as providers of capital for agricultural producers and other participants in the global supply chains they control.

Outgrower schemes

The so-called outgrower schemes for financing agricultural projects represent a special mechanism that involves several production and financial aspects of agribusiness activities.These schemes are formed around a leading company ("core") that seeks to expand the production of a particular product and encourages other companies to do the same.

In some cases, the "core" is not an agricultural holding, but a food manufacturer, exporter, or even a supermarket chain. Typically, this company provides the farmers participating in the scheme with everything they need to succeed in a specific market niche, including resources, technology, money and distribution channels. However, the financing of investment projects of this kind remains largely dependent on banks and other financial institutions.

On the one hand, these mechanisms to support and finance agribusiness carry specific risks.

Among the key risks, experts identify the following:

• The risk of crop failure and financial losses associated with the cultivation of one crop.

• Risks of extremely high competition, especially if the regulatory framework is imperfect.

• Market risks related to price and exchange rate.

• Credit risks and others.

On the other hand, outgrower schemes provide the leading company and neighboring small producers with numerous advantages in terms of increasing production and sales, improving quality, maintaining adequate product prices and generating stable and high income over the long period.

Indirect financing and securities

Instruments for indirect financing of agricultural investment projects include intermediaries who help provide resources for doing business and establish relationships between agricultural producers and end users.These financial mechanisms can include commercial and government banks, exporters, supermarket chains, canneries, grain elevators and other links.

The indirect financing of an agricultural project is carried out by placing borrowed funds against the future supply of products at a favorable price. The intermediary company turns to the bank to obtain financing for the project on the favorable terms, using its business contacts. Then the intermediary enters into a financing agreement with the manufacturers of the desired products.

At the end of the season, the harvested crop is checked for quality and sent to buyers under pre-signed contracts. Agricultural producers receive funding in the form of resources directly (fuel, fertilizers, seeds, equipment), and the money goes to them after the sale of the crop.

Intermediaries are responsible for repaying the loan to the bank.

The intermediary is responsible for minimizing transaction costs, providing technical assistance plus additional funding and facilitating the commercialization of the product.

The list of intermediary services includes, but is not limited to:

• Attraction of loans and financing.

• Optimization of financing, sales and payments.

• Contracting between farmers and buyers.

This agri-food project financing scheme requires an adequate technological, financial and legal infrastructure in the host country to enable the intermediary to provide services in a holistic manner.

Agricultural factoring

Factoring in agribusiness is a transaction whereby a farm or agricultural holding sells its receivables or its contracts for the sale of products at a discount to a specialized company known as a “factor”.This company pays the agreed price, providing the agricultural producer with the necessary funds.

Factoring accelerates the replacement of working capital, shortens the time it takes to receive invoices and provides reliable protection against credit risk. The role of the instrument in financing large agricultural projects is small, but factoring helps to build up internal resources of companies for the implementation of such projects.

Forfaiting

Forfaiting is somewhat similar to factoring, but this financial instrument is less common in agricultural finance.The scheme includes a specialized company (“forfaitor”) that buys the accounts and freely tradable financial instruments of the exporting company (for example, irrevocable letters of credit).

This financing option improves the current performance of the exporter of agricultural products and eliminates certain risks associated with receivables. Forfaiting is indirectly related to the financing of large agricultural projects.

Accounts receivable financing

Accounts receivable (AR) financing means that a bank or other financial institution advances the working capital of agri-food companies (suppliers, processors or exporters), accepting receivables or confirmed orders as collateral.This type of financing takes into account the amount of contracts and the credit history of the company. Agricultural producers often face financial difficulties due to the fact that they take too long to fulfill obligations under previously concluded contracts. Processors and exporters, in turn, must wait for full payment for the delivered products from customers. In such circumstances, farmers may be forced to sell their produce locally at unfavorable prices in order to get money quickly.

Accounts receivable financing is most beneficial when the products are insured and the buyer is deemed trustworthy.

While the mechanism is ideal for non-perishable food, it can be used for other types of food as well, as long as appropriate precautions are taken.

Having a strong regulatory framework in the host country is critical to this type of funding. Imperfect legislation in this area creates problems with debt collection in case of non-payment.

Collateralization of assets for financing agribusiness

The activities of agricultural enterprises are inextricably linked with risk.As production in this sector depends on unpredictable weather events, the success of each project is greatly influenced by drought, frost, hail and other insurmountable phenomena. All of this jeopardizes debt repayment.

These risks, along with market uncertainties and fluctuations in the prices of fuel, fertilizers and other resources, require collateral for loans in the form of land, equipment, products or other assets. The available collateral mechanisms largely determine the choice of funding model.

Agricultural leasing

Agricultural leasing is an investment financing option that is widely used in capital-intensive areas of agriculture that require the acquisition of high-value assets for a successful business.Leasing can be carried out in two forms.

In the first case, the ownership of the leased assets passes to the user after the last payment (financial lease), which makes the lease transaction closely related to the purchase and sale agreement. This type of contract is most commonly used in developing countries.

In the second case, the leasing company retains ownership of the leased assets (operating lease), so this type of relationship is essentially a long-term lease without the option to repurchase the assets.

For most leases, no collateral other than the leased asset is required. In both cases, payments must be made periodically. In case of violation of the terms of the contract, the asset can be returned to the lessor. In agriculture, financial leasing is more common.

Typically this tool is used to acquire long-lived assets such as tractors, mills, harvesters, and the like.

Leasing agreements promoted by banks in collaboration with major equipment suppliers often include significant discounts on equipment. This strengthens the capital base of agricultural producers with limited financial resources. It is also attractive to equipment manufacturers as it allows them to enter new markets and reduces the need to provide risky loans to farmers.

In some countries, leasing instruments are risky in practice because the local capital markets, legal infrastructure and methods of their application are underdeveloped and do not adequately protect the financial interests of all participants.

Warehouse receipts

The use of warehouse receipts allows farms to store products for a long time in specially equipped certified warehouses until the very moment of sale.In return, the warehouse issues a receipt to the manufacturers, which they can then provide as collateral when applying for a loan from the bank.

When the product is sold, the bank receives payment from the buyer in exchange for a receipt. After receiving this receipt, buyer can go to the warehouse and pick up the products. In turn, the bank transfers the rest of the money to the manufacturer minus the loan and interest.

These tools maintain the high quality of agricultural products for a long time and allow producers to sell products at the best price (for example, off-season or any other date).

Buyback agreement

This agricultural business financing instrument is based on agreements between two parties in which an agricultural producer sells his product to another agent at a certain price and commits to buy it in the future at an initially agreed price (usually a higher one).Buyback agreements secure loans using liquid assets and / or products (which serve as collateral).

These agreements reduce the cost of financing as they minimize the risk of non-payment.

Products are stored by accredited companies in certified warehouses that ensure the safety of these assets. These financing schemes work more efficiently in a mature market where products are easy to sell when needed. Buyback agreements are attractive to large agri-food companies seeking access to cheaper borrowed funds.

If you are looking for professional services in financial modeling, financial engineering or consulting for agricultural enterprises, contact our team anytime.

ESFC Investment Group is ready to provide financing for large agri-food projects, as well as provide comprehensive support for your investments at any stage.