After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

The LNG supply chain ensures energy independence and economic growth for companies or entire countries that do not have gas transmission systems.

Funding for energy projects today focuses mainly on renewable energy in the context of the global phase-out of fossil fuels, but gas remains an important element of energy security and sustainability.

During the 1990s and 2000s, project finance (PF), as a special type of debt financing for large projects, acquired strategic importance for the oil and gas industry and the energy sector in general.

The PF concept differs from traditional bank financing in that the financial flows of an investment project are closed to an independent company (SPV).

Debt repayment is carried out over a long period as the cash flows of the project are received, without requiring large collateral from the initiating companies and without burdening the current commercial activities of these companies with debts. This type of financing is widely used for natural gas production, as well as for the construction of gas pipelines, LNG plants and thermal power plants.

Financing of LNG regasification terminal projects, as well as other professional services in the field of engineering design, construction and operation of these facilities, are in growing demand.

The range of services of the international company ESFC Investment Group covers all stages of the liquefied natural gas cycle, including engineering and financial solutions for LNG supply, storage and regasification.

To find out more about the proposals of our company, contact our representatives.

Project finance for the construction of LNG terminals

The history of the production of liquefied natural gas for transportation by methane tankers goes back more than half a century, but this technology has been experiencing rapid growth since the 1990s.The LNG supply chain has resulted in huge savings on a global scale, and traditional gas exporters such as the United States, Russia and the Middle East continue to ramp up supplies.

The declining cost of LNG requires energy companies to look for more promising investment opportunities. In recent years, companies have been focusing on LNG production and regasification projects in new markets. Countries that refuse or are unable to import natural gas through gas pipelines are of increased interest.

Recent trends in the global energy sector require current exporting countries to diversify their natural gas supply systems.

In this context, special attention is paid to the production, transportation and regasification of LNG, which is clearly evidenced by the recently adopted government programs in Russia and a number of other countries.

Sources of income from regasification terminals include:

• Purchase of LNG and gas supply via pipelines to end consumers.

• Regasification of LNG for the production and sale of electricity.

• Selling excess terminal capacity to other companies.

Regardless of the specific goals of the investment project, all participants in the liquefied natural gas chain depend on each other and require guarantees that the technical and financial obligations of their partners will be fulfilled.

From the LNG supply agreement to the power purchase agreement (PPA), all the links in this chain function as one.

Financing the construction of an LNG regasification terminal is an important element in the successful operation of the entire energy chain. There are many options offered here, but it is important for the initiators of the project to identify reliable financial partners who are able to provide sufficient funding on acceptable terms.

The role of project finance in the oil and gas sector

Project finance is one of the main ways to finance large projects with long payback periods, which is very successfully used in the construction of LNG plants and regasification terminals of all types.Interesting fact.

It is estimated that from 2000 to 2010, project finance instruments were used to build regasification terminals with a capacity of about 100 mtpa (million tonnes per year), which corresponds to 40% of the total capacity added during this period.

Why has the PF concept become so popular in the oil and gas sector, taking an important place in the LNG chain?

Companies cite several reasons for this.

Regasification terminals are distinguished by their high cost.

The investment costs of building such facilities in some cases easily exceed € 10 billion, making traditional bank financing difficult.

Using project finance can be cheaper than long-term loans, since the risk associated with a well-considered investment project may be lower than the risk of bankruptcy of the borrowing company. An additional guarantee of the return of funds are long-term contracts with gas consumers, which ensure capacity utilization for 15-20 years or more.

Companies set up SPVs to receive financing from various sources, ensuring that the debt is repaid from future cash flows.

As the LNG regasification technology is considered mature, well studied and reliable, this condition does not raise concerns among investors. These investors can be state-owned banks, commercial banks, investment funds, large private investors, export credit agencies and international financial institutions.

Project finance attracts many interested sponsors, ranging from oil and gas companies to large consumers looking to secure fuel supplies in the future. The complex multifaceted nature of legal relationships arising in these projects is best reflected in numerous PF models.

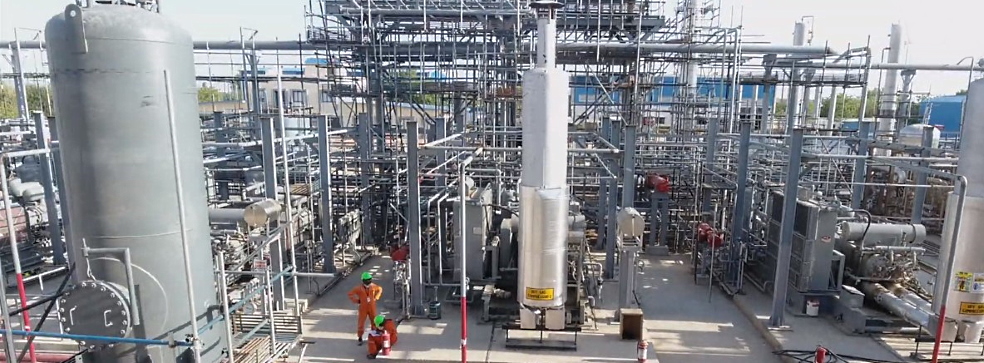

Figure: Integrated structure of LNG terminal project finance.

Ownership structure of LNG projects

In terms of ownership of assets and the structure of financing projects related to the production and regasification of liquefied natural gas, experts identify several models used to implement these projects.Depending on the planned sources of income (tolling, gas supplies to end users, electricity generation), LNG regasification terminal projects can be financed according to different schemes using a single SPV or several independent companies.

On the one hand, project participants can use an integrated approach, when the project combines an LNG regasification terminal and a gas-fired power plant under one roof.

Such projects provide higher added value by combining two stages of converting fuel to energy.

However, experts note the lack of flexibility and adaptability of such projects.

Another approach assumes separate ownership with the establishment of separate SPVs that implement the construction of the LNG terminal and power plant. This approach is used in developed gas markets, where it is easier for the terminal owner to negotiate with several consumers.

Of course, the initiator of the LNG regasification terminal project must weigh the possibility of concluding contracts with potential customers in the event of a failure of the power plant project.

For its part, the initiator of the construction of the power plant should assess the possibility of supplying fuel from alternative sources or even transferring equipment to another fuel in case of problems with LNG supplies.

In some cases, the construction of the gas-fired power plant and the LNG terminal is carried out by two formally independent companies, with funding provided by the same group of investors.

Such schemes are characterized by very complex contractual terms that ensure a delicate balance of interests of the parties.

Project finance risk management

Regardless of the format, project sponsors are committed to minimizing risk and guaranteeing support in the event of failure, which is why they often look to governments for formal guarantees.In general, investors are looking for a rational distribution of risks and compliance with contractual obligations by the parties.

Table: Risks of the LNG regasification terminal project for the sponsor.

| Risks | Short description |

| Construction risks | Construction risks includes any problems that may arise during engineering design, equipment procurement and facility construction. An EPC contract with a single, responsible general contractor, with penalties for violating construction deadlines, can guarantee that the project will go as planned. |

| O&M risks | Equipment operation and maintenance risks are associated with low competence of contractors. This risk can be minimized by entering into appropriate contracts with a reliable O&M contractor. |

| Consumption risks | Insufficient workload of the LNG regasification terminal and related facilities can lead to a disruption in the cash flow necessary for timely debt repayment. This requires preliminary negotiations with various potential LNG consumers and electricity buyers. |

| Gas supply risks | Projects with one major LNG supplier are at serious risk in the face of market changes and require diversification. Gas supplies should be reserved from several companies (preferably from different countries) to protect business. |

| Financing risks | The contractual terms to ensure the repayment of the debt must be sufficiently reliable. In some cases, the sponsor may need formal guarantees and collateral. |

As follows from the table above, most risks can be minimized by concluding appropriate agreements, as well as conducting an in-depth analysis of all potential threats, including economic, geopolitical and others.

Attention should be paid to the Electricity Purchase Agreement (PPA), which should guarantee sufficient financial flows to service debts according to the established schedule. As some projects involve the simultaneous construction of an LNG regasification terminal and a thermal power plant, this agreement becomes critical to success.

As these projects are limited to revenues generated from the sale of electricity, potential sponsors carefully scrutinize the agreement and analyze factors such as the current financial health and prospects of large consumers, market conditions and forecasts for its development in the long term.

Financial institutions that are allocating many billions of euros for the project will want to secure their investments, including through the PPA.

Project finance means that the SPV's debt is repaid only from the cash flows generated by the project during its operation phase. Consequently, financial institutions are interested in the smooth implementation of the investment plan and reaching the planned capacity. Any changes that could negatively affect cash flow need to be discussed.

Financing LNG terminals: our services

ESFC Investment Group, a Spanish finance company with an international presence, offers project finance for the construction of LNG regasification terminals.We are ready to meet the most challenging customer requirements for the successful implementation of ambitious energy projects onshore and offshore.

Three reasons to work with ESFC:

• Reliability and flexibility. With significant resources and partnerships with leaders in the financial sector, we ensure that all commitments are met. Our company is always open for negotiations in order to adapt the financing conditions to the business opportunities as much as possible.

• A wide range of services. ESFC offers project finance, long-term loans (including financing 100% of the investment costs), refinancing on favorable terms, as well as engineering and consulting.

• International experience. Our professional team has accumulated rich experience in implementing large investment projects in Europe, USA, Latin America, the Middle East, North Africa and other regions of the world.

We provide flexible long-term financing and qualified financial and legal support.

Our range of services is constantly expanding in line with the expectations of big business to facilitate successful implementation of your LNG projects anywhere in the world.