After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

Both companies were looking for new opportunities, while competitors complained about the high cost of new technologies and continued to rely on oil and coal.

Both companies are leaders in the green energy market today, and their advantage is unlikely to be taken away anytime soon. With the decision to develop distribution networks and invest in green power plants, they have managed to squeeze out the oil giants and retain the trust of their customers.

European oil companies such as Royal Dutch Shell, British Petroleum and Total are now starting to focus on electrification, but have yet to enter the battle for a market that Enel and Iberdrola have dominated for many years.

The two companies have taken very strong positions as clean energy suppliers, predicting the end of the fossil fuel era a decade ago.

The energy transformation of the two companies is helping to increase revenues, share prices and dividends even in the face of a pandemic.

Their share prices have skyrocketed over the past two years as investors have begun to phase out coal, oil and gas and move towards clean energy.

Other green companies are also benefiting from this transformation, such as the US company NextEra Energy, which specializes in solar and wind power generation, and the Danish company Orsted, which focuses on offshore wind energy.

For Enel, the changes began back in 2008 with the creation of the Enel Green Power division. Shortly before that, the company took over the Spanish Endesa, which gave it access to the dynamic markets of South America.

Iberdrola took this path even earlier, in 2001.

The company decided to close its fuel oil thermal power plants with a total capacity of 3.2 GW. In 2020, the company closed two coal-fired power plants. Iberdrola has started investing in green energy, mainly in wind farms. In just a few years, its investment portfolio has grown from 352 million euros in 2001 to over 1 billion euros in 2004.

Investors were skeptical at first, but only three years later they realized that the managers' decision was right.

As a result, both companies have a significant edge today, and competitors are unlikely to catch up. According to a Rystad Energy analysis, in 2035, despite the ambitions of the oil giants, Enel will remain the leader in the green energy market, followed by Iberdrola and NextEra.

The first two have another big advantage, millions of kilometers of power grids in Europe, the United States and South America.

Power grids are one of the basic elements of an energy conversion system that must be flexible and versatile.

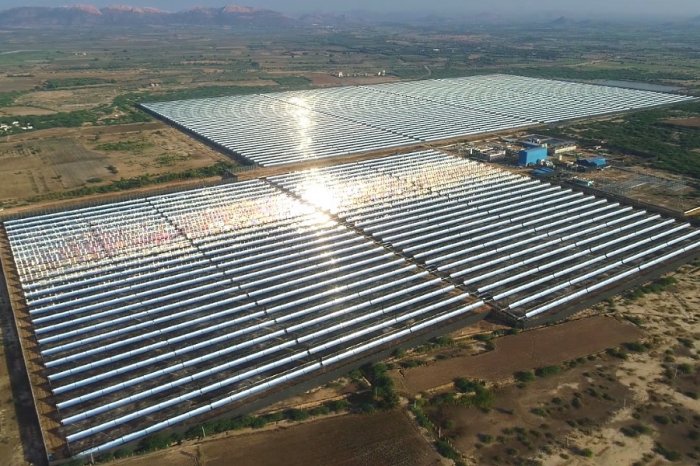

In fact, new entrants to the market have yet to gain access to these grids in order to supply energy to their consumers. In November 2020, Enel announced that it will invest 150 billion euros in innovative assets to reduce its hydrogen emissions by 80% by 2030. The company also intends to accelerate the development of its power grids and triple the installed capacity of green power plants to 120 gigawatts.

Iberdrola's plans are similar, with an innovative energy strategy focused on developing electrical grids in the United States as well as increasing green capacity.

The world needs to invest over $ 130 trillion in green transformation

According to the International Renewable Energy Agency, investments in environmental projects are set to grow by 30% in the coming decades.To achieve environmental goals, investments in global energy transformation must rise to $ 131 trillion by 2050.

IRENA's calculations mean that the global energy industry needs an average of $ 4.4 trillion a year to meet its plans. This will enable the world to prevent air temperatures from rising by more than 1.5 ° C by the end of the century.

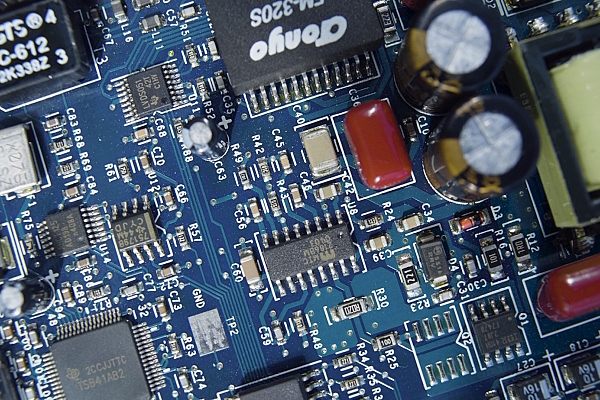

This climate goal can be achieved through a combination of technology and innovation to support green transformation, manage greenhouse gas emissions, and improve social and economic life.

That is why IRENA proposes to intensify international cooperation in the field of renewable energy sources.

There are many zero-emission technologies currently available for energy systems using renewable energy, green hydrogen and biofuels. IRENA experts are convinced that in the coming years they will dominate the energy sector.

However, to achieve these goals, a combination of expensive new technologies is required.

Key areas for the development of the energy sector include increasing energy efficiency of production, which guarantees continued economic growth, as well as decarbonizing energy systems through the widespread introduction of renewable energy sources (in the latter, the aforementioned companies Enel and Iberdrola have succeeded). By the middle of the century, the capacity of renewable sources should increase 10 times.

Experts also propose to focus on the electrification of buildings, industrial enterprises and transport, which will help to significantly reduce overall CO2 emissions.

In addition to IRENA's recommendations, they see the promotion of green hydrogen production, biofuels and the targeted use of sustainable biomass as ways to achieve their goals.

It is estimated that by 2050, about 30% of electricity generated from renewable energy sources will go to the production of biofuels and hydrogen.

With the growing demand for renewable energy financing, markets and investors seem ready to move away from fossil fuels and reorient towards energy innovation.

ESFC, a Spanish company with an international presence, is ready to offer flexible financial and engineering solutions for the renewable energy sector, including the construction and modernization of solar and wind power plants.

Contact our consultants to find out more.