After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

Such an investment project takes at least 2-3 years.

Given the repayment schedules of borrowed funds, project sponsors should seek long-term funding for a period of 12 to 15 years or even more.

Lenders, investors and initiators of a hotel project seek to enter the business on the most favorable and safe terms, including minimizing any project restrictions and credit risks. It is obvious that a comprehensive professional study of the project and complete mutual understanding between the participants lay the foundation for making successful investment decisions.

ESFC Investment Group offers long-term financing for the construction and modernization of hotels around the world.

Our team also provides a full range of services in the field of project finance (PF), investment engineering and consulting.

Basics of financing hotel investment projects

Based on the investment costs and the contribution of the initiator to the investment project, the financial team builds a rational structure for financing the hotel business.The structure of financing projects of hotels and tourist complexes can be quite diverse, depending on the type of project, its goals, risk level, financial needs and other factors.

Often, banks offer various project finance solutions to finance hotel projects. This is a special type of financing that isolates the assets and debts of the project from its initiators. In essence, this means the establishment of a new legal entity (Special Purpose Vehicle, SPV), which will have its own assets, independently settle accounts with creditors, and be fully responsible for project debts.

Banks, realizing the long period of financing and the high uncertainty associated with it, are trying to minimize long-term loans and reduce the maturity of the debt.

Such approaches include dividing the financing plan into an investment loan and a revolving loan.

Another widely used method of shortening the terms of financing is the issuance of a short-term loan for the period of investment. If the investment project is carried out in accordance with the original business plan, the short-term loan will be repaid by the leasing company that is built into the investment project (leaseback).

Another way to reduce credit risk is to provide a so-called balloon loan. A balloon loan is usually issued for half the term of an investment loan. If a company applies for an investment loan with a maturity of 12 years, the applicant can receive a balloon loan with a 6-year financing period.

With a shorter financing horizon, this type of loan gives the bank greater confidence in the market and the economy going forward. Less risk means cheaper funds.

At the end of the first financing period, under certain conditions, the loan agreement opens up opportunities for continuing cooperation for a further period (in our case, this is another 6 years).

This option is used by banks when a hotel project reaches predetermined targets during the first funding period. Otherwise, the loan agreement ends and the company has to repay the remaining debt, usually 50% of the loan.

There is a long list of assets and schemes to secure a loan.

Typically, the bank expects collateral that is more expensive than the loan provided, usually in a ratio of 3:2 or 2:1.

The list of instruments that can be used to secure an investment loan includes the following:

• Land for the construction of a hotel.

• The hotel under construction and its infrastructure.

• Highly liquid movable property of the borrower.

Banks can also accept various types of loan guarantees and require the borrower to limit the payment of dividends and other active actions to ensure debt repayment.

An important role in financing projects is played by the contribution of the initiator. The more funds the borrower allocates for his own project, the easier it is to get an investment loan. Given the uncertain situation in the sector, today banks require a minimum of 30-50% of the initiator's contribution to issue a large loan for the hotel business.

However, there are more profitable schemes for financing hotel projects, allowing companies to raise large funds with an initial contribution of the initiator at the level of 10%. To find out more, contact ESFC Investment Group consultants.

Cost of capital and efficiency of a hotel project

The structure of investment financing determines the cost of capital.This cost will include the cost of the loan specified in the agreement, the expected rate of return on equity (ROE) and the expected rate of return on capital obtained from alternative sources (eg venture capital funds).

The expected rate of return on equity is higher than the cost of debt because business owners expect above average returns on their capital. Returns at the level of the cost of borrowed funds with a high level of business risk would probably not satisfy project initiators.

This cost must also be higher than the so-called opportunity cost, i.e. the company's potential return on the best investment available to owners, excluding the hotel project. The expected rate of return on capital received from investment funds is the highest because these funds, having wide access to competing investment projects, will follow the goal of maximizing return on invested capital.

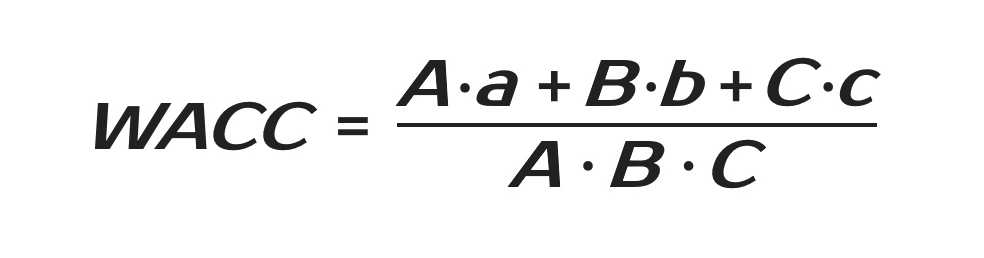

The weighted average cost of capital (WACC) for a hotel business can be calculated as follows:

A — cost of a bank loan;

a — share of the loan in the capital structure of the project;

B — cost of equity capital used in the project;

b — expected rate of return on equity;

C — cost of borrowed capital from other sources;

c — expected rate of return on capital raised from other sources.

The higher the WACC, the worse the return on investment.

Therefore, in the structure of financing hotel projects, the ratio of various sources of capital, depending on its cost, is important.

A very important indicator of project performance is the NPV (Net Present Value) ratio. It shows that at the assumed weighted average cost of capital (WACC), the cash flow generated during the loan period will be able to cover operating expenses and provide an adequate return on borrowed capital. If NPV is negative, such investments should not be made.

Another measure of return on investment is the internal rate of return (IRR).

This indicator must exceed WACC.

There is a simple relationship between these indicators. If IRR = WACC, then NPV = 0.

This means that, taking into account the time horizon of financing, the company will receive exactly as much money as it has invested.

This applies to both equity and debt.

One of the problems in financing hotel projects is to match the financing period to the type of assets that will be created (purchased) for these funds. Experience shows that the company's fixed assets should be financed from equity and long-term debt, while current assets can be formed from long-term debt and short-term financing.

Table: Fixed and current assets of a hotel project.

| Fixed assets | Current assets |

| Expensive assets with a long lifespan, including land, buildings, vehicles and other property. | Assets with a short life span, including furniture, building materials, and so on. |

| Long-term accounts receivable. | Short-term accounts receivable. |

| Long term investments. | Short-term investments. |

| Intangible assets. |

Hotel investment, management and operation

Investors are always interested in finding the most effective financial solutions. Thus, the hotel business in the conditions of the post-Covid recovery of the industry becomes quite attractive for investment.Several areas of investment are considered in this sector:

• Construction of new and acquisition of already built hotels.

• Reconstruction of hotels and previously unsuitable premises.

• Investing for the purchase of individual hotel rooms and apartments.

• Investment in hotel management, technologies, personnel training.

• Purchase of a well-known brand (franchise).

Hotels are real estate that can be the object of investment by various economic entities, from hotel operators to large investors focused on real estate.

As an investment property, apart from capital, hotels require a highly skilled team to manage and operate. This greatly differentiates hotels from other commercial properties, such as offices, where management does not exist or is within the reach of any small company or even individual.

Hotel investment, dedicated to serving both business and leisure travelers, has been in clear development for decades, which is a consequence of the relationship between economic growth and travel at the regional and international levels. The expansion of this industry brought with it close cooperation of hoteliers with other agents that develop their activities around the hotel business.

In many cases, the operation of hotels is separated from ownership, which creates a separate figure of the hotel investor and a separate, no less important figure of the hotel business operator.

Investor-operator relationships are often the subject of business analysis and consulting and lead to numerous real estate investments and sales transactions.

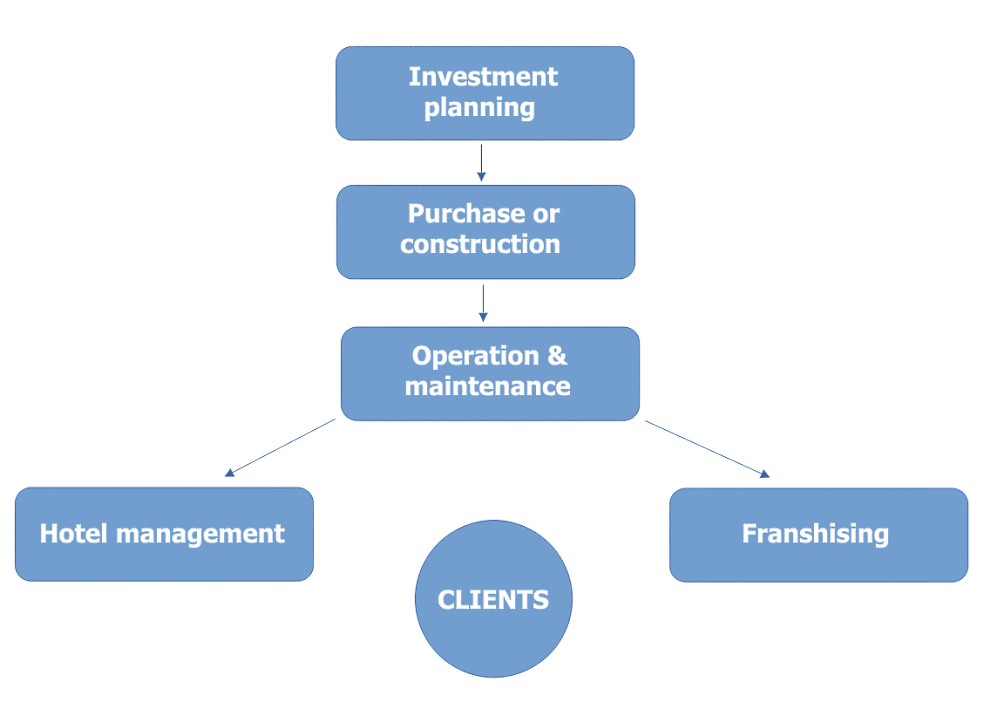

The diagram below shows five different types of business activities that can be developed around a hotel property. In some cases, one company can perform all of the above activities. In other models, there may be companies that combine two or more activities, and sometimes a hotel is financed and operated by five different companies.

Investment planning and development

This stage of the investment process in the hotel business is similar to the development of other projects.This usually starts with the purchase of land, although it can also start with a hotel that needs major renovations or a building that has been repurposed.

Activities required for successful completion of this stage include site selection, land acquisition, design and engineering services, construction or purchase of real estate. Risks associated with each of these activities include the suitability of the location and design, the time frame, cost and quality of construction, and the state of financial markets at the time of purchase.

Building or purchasing a hotel

Property ownership is the basis of investment activity.A pure investor buys the property from the developer, does not risk owning the land or construction, and leases the hotel to the operator. If the contract includes a fixed rent, the investor also does not bear operational risks.

Hotel investment management includes the development of an appropriate portfolio, geographical diversification and asset diversification, choosing the right time to buy each property, choosing the operator and type of contract, tax optimization and financing of the specified portfolio. A successful purchase lays the foundation for the further success of the project.

It is worth noting that this stage accounts for the majority of project costs, sometimes up to 80% of the cost of a hotel project.

Hotel operation and management

Effective management is aimed at increasing property profitability.In this context, it is necessary to take into account risks arising from the real estate market, the financial market, the hotel market, as well as the specific type of agreement.

As the owner takes over the maintenance of the property, a new area of risk management emerges.

Management contracts contribute to the expansion of hotel chains without involving large investments. Large foreign operators, as a rule, do not enter the business, but provide competent management of the hotel, which is very important, especially for expensive hotels. In management, the risk of the operator is insignificant, since this activity is not related to investments at all or the volume of financing is minimal. All losses from the main activity are borne by the hotel owner.

The structure of the hospitality industry is different from most sectors of the economy, and some managers in this industry do not fully understand how it all works. Managing a hotel is a complex task that requires a variety of skills and resources.

To maximize productivity and profitability, many hotels use professional organizations to manage various operational aspects of hotel business.

Hotels usually use one of four forms of ownership and management:

1) Private ownership and management. For the owner, this model requires the greatest practical effort in operating the hotel. In private hotels, the owner takes charge of all aspects of the business: hires staff, monitors the technical condition of equipment, implements a marketing strategy, and much more. The owner can be both a private person and a group of owners.

2) Long-term lease. Unlike private hotels, the owners lease the physical asset to another company that handles all aspects of operation. The owner simply receives a certain fee for the use of the asset and does not take any part in the operation of the hotel.

3) Franchising. Owners who want a more practical approach and don't want to transfer their physical asset to manage someone else, can choose a franchise model. Franchisors sign agreements with hotel brands to access benefits such as brand standards, marketing opportunities, reservation systems and design recommendations. Franchisors often manage day-to-day operations themselves, such as hiring and paying employees and paying the brand's franchise fee.

4) Management. The hotel owner signs a contract with a professional management company that takes over all operational responsibilities. Unlike the franchise model, the management company handles everything related to day-to-day operations, even recruiting, payroll and marketing. Some managed hotels are branded, in which case the managing company is responsible for upholding the brand's standards. Typically, the owner signs a contract with the brand, although owners often involve their management company in rebranding discussions. These management companies are focused on RevPAR, NOI and EBITDA growth as they receive a percentage of revenue and other bonuses based on hotel profitability. Corporate hoteliers tend to focus on strategic tasks such as SWOT analysis and SMART goal setting, while a management company focuses on tactics, day-to-day management and service delivery. Many hotels around the world have separate ownership and management in order to maximize the efficiency of both components. Owners can focus on real estate and management companies on day-to-day operations. In particular, large hotel companies such as Hilton and Marriott typically do not operate their own hotels.

Here are the benefits of a hotel management company, how management companies manage hotels on behalf of the owner, and their functions.

Depending on the specifics of a ninvestment project, the management company can provide the following:

• manage all operational departments, such as reception, sales, catering and others;

• manage relationships with suppliers and issue invoices;

• to carry out price policy in the institution and conduct advertising campaigns;

• perform day-to-day maintenance of the hotel and make recommendations on expenditures;

• develop budgets and prepare financial reports for owners;

• develop and maintain the hotel website and implement marketing strategies;

• coordinate renovations work, etc.

If the hotel is branded, then some of these duties are performed by the brand. Brands usually provide marketing support, corporate service standards, and furnishing and decor recommendations. Regardless of brand affiliation, the management company is usually not involved in major decisions regarding the physical assets. A hotel owner or group of owners (often a real estate investment group) decides when to buy or sell a property.

Using management services can save you money in the long run. Management companies are experts in the hotel business, so they can often run day-to-day operations more efficiently than owners, especially if they have little experience in the hotel business.

Investments in hotel business after COVID-19

The pandemic has had a very strong impact on the global economy, causing about 6 million deaths as of early 2022 and paralyzing economic activity due to lockdowns and restrictions.Over the past decade, the tourism and hospitality sector has outpaced the growth of the global economy.

However, in 2020, tourism has returned to the level of 30 years ago. According to experts, before 2024, the leading European tourist destinations are unlikely to reach pre-pandemic levels.

The recent quarantine restrictions caused a significant drop in the tourism and travel industry, reducing global investment in the sector from $986 billion in 2019 to $694 billion in 2020. At the same time, global investment in hotels fell from $73 billion in 2019 to $28 billion in 2020. In 2021, as restrictions are eased around the world, this figure has skyrocketed to almost $67 billion.

The second half of 2021 was accompanied by some improvement in key hotel business indicators, including an increase in RevPAR and hotelier profits. Although the tourism and hospitality industry began to demonstrate some signs of recovery in 2021-2022, a war in Europe, disruption of logistics chains and slowdown of the global economy have threatened investments in hotel construction and tourism.

Under these conditions, businesses are forced to look for more flexible investment solutions and more affordable sources of long-term financing.

There are many recovery scenarios for the hotel business, including different recovery periods for different segments, from luxury to economy class. The cost of operating large hotels is critical in this uncertain environment. Budget hotels can remain open with lower occupancy rates than others. For owners considering suspending operations, variable costs are key factors to consider as fixed costs do not change under any circumstances.

Rising demand and lower operating costs suggest that budget hotels will recover much faster. This would be in line with what we saw during previous crises. Hotels that rely on meetings, conferences and other events may face more significant challenges.

If you are looking for the optimal model for your investment project, please contact our team for advice.

ESFC Investment Group offers hotel business financing and long-term loans for tourism and travel projects in the post-Covid era. We organize advanced project finance schemes for the construction of large hotels and resorts, as well as provide comprehensive professional support for our clients at all stages of the project.

Contact us to find out more.

The role of investment consulting services in hotel business financing

More than 10 years of financing a hotel project is a very long period of time, which is associated with many risks.During this period, the economy of the country and the world market may suffer a crisis, and then the target parameters laid down in the investment plan will not be achieved.

The hotel business is assessed by banks and investors as particularly sensitive to economic and geopolitical factors.

This means that unforeseen circumstances (such as quarantine) can cause a sharp drop in demand for hotel rooms, a general decline in prices and financial results in the hotel business. All of this means debt service problems.

The sensitivity of the industry is explained by the fact that these unforeseen downturns can be deeper and longer than the average fluctuations in the global economy.

Most banks develop indicators that reflect the sensitivity of a particular sector of the economy in relation to average values.

The use of these indicators when evaluating a hotel project will improve the understanding of financial risk by participants and thus may lead to changes in credit requirements.

In developing countries, banks do not have up-to-date data on brands, locations, types of hotels and other niches. Therefore, in their financial projections, lenders refer to the situation in the industry as a whole. The goal of the project initiator is to convince the bank of the credibility of its plan.

The lifetime of investment projects in the hotel business reaches 35-40 years or more, depending on the type of project. During this period, the hotel is undergoing renovation and modernization, but those gross mistakes that could have been made at the stage of planning / implementing an investment project are extremely difficult to correct.

What if the initiator has no experience in the hotel business?

The best solution is to use the services of a company that specializes in investment engineering and consulting.

The ESFC team will conduct the necessary research, develop an optimal financing model and offer the necessary financial resources for the implementation of the hotel project.