After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

Experts expect that the revenue of the mining and quarrying industry in Germany will exceed €22 billion in 2022.

With an expected average annual growth rate of 3.6%, mining is currently providing stable profits for more than 1,400 companies.

Large business has interests in such sectors as mining of iron ore, rare earth elements, lignite, natural gas, and uranium. Huge investments in Germany are made in the production of potash and other industrial minerals such as kaolin, feldspar and barite.

As for the production of construction materials (gravel, sand, natural stone, lime, clay, pumice stone), these minerals are mainly extracted by small and medium-sized companies, but these investments are extremely important for construction, infrastructure development and industry.

Under the current strategy, Germany plans to increase investment in mining, which is crucial for the innovation economy of the future.

This concerns the increase in the production of copper, indium, gallium, cadmium, selenium, tellurium, neodymium and other elements used in modern industry. At the same time, the future will bring an inevitable reduction in financing of thermal coal production and a number of other minerals that were actively used in the 20th century.

It is obvious that today Germany, like other leading economies of the EU, faces serious problems. In September 2022, indicators of the business climate in the country fell to a record low level since the pandemic. On the eve of winter, the expectations of German business are pessimistic due to the ongoing war in the east of Europe, the resulting increase in fossil fuel prices and the slowdown of the world economy.

This has a negative impact on investments in the mining sector, which supplies raw materials to other industries and reacts sharply to any turmoil in the economy.

Nevertheless, Germany remains a powerful industrialized country with a long tradition of mining and significant reserves of resources such as iron, copper, nickel, lignite, rare earth elements and others. As the largest and strongest economy in the European Union, Germany continues to attract investors in the long term.

This applies, in particular, to the mining industry, which is able to provide the necessary resources for industrial growth for decades to come.

The history and current state of mining investments in Germany

Germany is one of the classic European mining regions with a long tradition in the extraction and processing of minerals.Lead, copper, silver and iron were mainly mined until the 19th century. At the time, the focus was on coal and iron in the context of the Industrial Revolution. In the 20th century, there was also intensive mining of uranium ores, which, among other things, became the basis of the Soviet nuclear power industry.

Mining in Germany has existed since the 5th millennium BC and developed with varying degrees of success.

The flint mine in Abensberg-Arnhofen is one of the oldest evidences of the Neolithic era.

The Celtic period of iron and copper mining was followed by an intensive Roman period of mining industry development. Ore and salt mining dominated from the late Middle Ages to the modern era. In the 18th and 19th centuries, large landlord mines operated successfully in Germany.

Mining has left a deep mark on the history of Germany. In the German mining regions, a special mining culture developed, which contributed to the development of regional identity. Mining science and education was also established in Germany earlier than in most European countries. The historical role of mining has influenced the legal relations, the cornerstones of which were Bergregal (right of ownership of untapped mineral resources) and Bergfreiheit (the right to search for and extract minerals regardless of land ownership).

Germany's modern basic materials sector, including the mining industry, produced goods worth more than €260 billion in 2012, which was about 6.4% of total production, and employed about 1.2 million people.

Lignite production in the same year exceeded 12 million tons, which allowed Germany to largely meet the needs of its thermal power plants.

In terms of product mix, German mining companies produce a wide range of metal ores, hard coal and lignite, as well as stone of different fractions, with lignite being an important energy source in Germany for a long time. Coal mining was significantly reduced in 2018 due to the low competitiveness of local mines on the international market.

As Germany is phasing out the use of lignite for power generation, this will have a major impact on traditional lignite producing regions in Germany. To support the change, these areas will receive up to €14 billion from the federal government for structural investments by 2038.

Oil production in Germany started relatively early and covered a third of domestic demand until the 1960s, but now the share of local companies is currently only a couple of percent.

More than half of German natural gas production comes from Lower Saxony, specifically the Weser-Ems area.

It currently covers approximately 10% of domestic natural gas needs.

Germany is still known throughout the world for the production of mining equipment, the provision of mining engineering services, as well as high-quality university education in mining. Geological exploration work is actively conducted in some areas, which contributes to the development of investments in new mining projects, especially in the south of Germany.

In particular, in the Ore Mountains, work is underway to restore the mining of tungsten, tin and indium deposits.

Distribution of coal and ore deposits in Germany

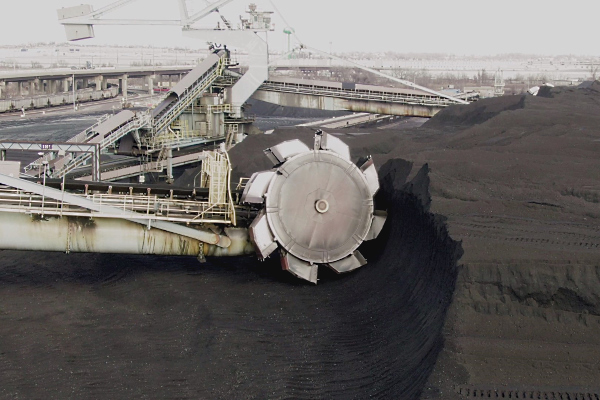

Germany has huge deposits of hard coal and lignite.While hard coal often occurs at great depths and is mined underground, lignite occurs at shallow depths and can be mined in open pit mines.

The most important coal-mining areas were the historical Ruhr region and the Saar region. The Aachen, Ibbenbüren and Erkelenzer Horst areas have reserves worth further investment. On the other hand, the Zwickau-Oelsnitzer Steinkohlenrevier deposit is considered well-developed. In addition to these deposits, there were other smaller deposits, but they were either exhausted or not worth mining. The Doberlug-Kirchhain deposit never got beyond the exploration stage.

On a global scale, Germany has large reserves of explored and exploitable deposits.

Unfortunately, at a certain point, coal mining was stopped in 2018 after the cancellation of government subsidies.

With approximately 180 million tons of lignite mined in 2012, Germany was #1 in the world. Lignite accounted for about 25% of the electricity produced in Germany. In the 2010s, the phasing out of lignite-fired power generation as a result of the energy transition was slow. In 2017, lignite still accounted for 23% of Germany's electricity. Final termination of investment in lignite mining in Germany is planned no earlier than 2038.

Moreover, rising pipeline gas prices may slow down the process of phasing out lignite mining.

Financing lignite mining is mainly limited to three major areas: Lusatia, Central Germany and the Rhineland. The Helmstedt deposit is of secondary importance. Other smaller and depleted deposits are found in North Hesse, Borken Wetterau and Upper Palatinate.

For a long time, ore mining was essential to the German economy. Over the centuries, there were several thousand mines in different parts of the country, mainly in its southern part. In certain historical periods, the mining of silver, tin, bismuth, cobalt and uranium played a prominent role. All other ores had more regional significance.

Today, deposits of tin (800,000 tons), tungsten (230,000 tons), bismuth (18,000 tons) and uranium (130,000 tons) are of great investment importance for local companies.

The volumes mentioned include only the deposits in Saxony and Thuringia, the richest in these minerals.

Germany's only deposit of nickel ores in Kallenberg was discovered in 1951, and in 1990 mining was stopped. Known residual reserves amount to 46,000 tons of nickel. Tungsten mining facilities worth mentioning was only at Zschorlau, Pechtelsgruen and Tirpersdorf. The undeveloped deposits at Bernsbach, Delitzsch, Antonsthal, Globenstein and Pohla contain 200,000 tons of tungsten.

Basics of financing mining projects in Germany

In 1982, the Federal Mining Act (Bundesberggesetz, BBergG) was adopted, which is currently the most important legal mechanism for regulating the extraction of mineral resources in Germany.The legislative framework of the mining industry also consists of the Federal Regulation on Mining Activities, the Regulation of Deep Drilling, the Regulation of Shelf Mountains and other acts. The Federal Mining Act authorizes the German federal states to issue their own regulations.

Over the past decades, a complex system was created in the country, which regulates the financing of mineral extraction and processing projects.

Financing of mining projects in Germany and abroad is carried out by dozens of financial institutions, in particular by such large banks as Commerzbank, Deutsche Bank and DZ Bank.

The policy of German banks regarding lending to fossil fuel projects is different and largely depends on situational factors. In particular, Deutsche Bank halved lending and other forms of financing for such projects from $21.8 billion in 2016 to $11.9 billion in 2019, continuing this trend in the following years. Commerzbank, on the other hand, has more than tripled its fossil fuel financing over the period, from $1.1 billion in 2016 to $3.8 billion in 2019.

When it comes to financing fossil fuel production, leading German banks are still providing long-term credit resources to thermal coal projects and gas production projects.

However, the fossil fuel financing until 2022 decreased due to the change in the European energy strategy.

Despite the large reserves of minerals, German business actively cooperates with foreign companies, extracting valuable minerals all over the world. This is a strategy of reliable protection of business interests. Germany has developed a reliable system of support for investment projects in the mining industry, which is based on credit guarantees of the Federal Government (Untied Loan Guarantee, UFK).

This system has been helping companies protect their interests since the 1960s.

The role of project finance in mining development

Project finance refers to large-scale mining projects in which operating costs and debt service funds are generated by a project after its launch.The main focus of the PF participants is on economically and legally independent special purpose company (Zweckgesellschaft), which acts as a borrower.

An SPC is an entity created for the sole purpose of conducting securitization transactions with the intention of separating the obligations of the SPC from those of the project originator. This form of financing is based on the project's cash flows ("cash flow lending") and is off the investor's balance sheet ("off-balance sheet financing").

Special purpose entities are founded when several companies join forces to implement a mining project such as the construction of a large processing plant.

This allows the risk of the lender and the entrepreneur to be limited to this project.

SPC is not a well-defined concept in German law. It is also unknown in corporate law, which only deals with the statutory choice of company forms in the legal sense. Thus, the term "special purpose company" serves only to describe the limited corporate purpose or responsibility of the legal entity. The legal concept of a SPC is used in the German Banking Act (Kreditwesengesetz, KWG) as well as in the Insolvency Code (Solvabilitätsverordnung, SolvV).

Currently, the role of project finance mechanisms in the development of the mining industry in Germany continues to grow.

This is partly due to the high costs, risks and uncertainties associated with further exploration and production of most types of minerals on the European continent.

The largest mining facilities in Germany

Germany is considered a country with relatively small reserves of minerals, but two-thirds of the raw materials needed by the economy come from local mining facilities.Germany does not have huge deposits of oil, natural gas or rare earth elements.

Nevertheless, the mining industry produces more than 40 types of minerals with a total volume of more than 700 million tons.

Of great importance to the German mining industry are sand, gravel, limestone, clay, salt, iron ore, copper, nickel, timber, uranium, as well as some types of traditional fossil fuels, such as thermal coal and natural gas.

Listed below are the largest operating mining facilities in Germany, such as quarries and mines. This list provides a better understanding of the geography of the German mining industry and the prospects for investment and development of the various sectors.

Tagebau Hambach

Tagebau Hambach (Hambach surface mine) is the open-pit coal mine operated by RWE Power in the Rhine lignite mining area and the largest lignite mine in the European Union.This huge mining facility covers the territories of several municipalities, which causes certain problems for local communities and the environment. At 299 m below sea level, the lowest point of the Hambach surface mine is the deepest man-made depression in North Rhine-Westphalia.

The project's operator, formerly known as Rheinbraun, initiated the open pit approval process in 1974. The first work on the mining site began in 1978. This was accompanied by the resettlement of villages and the cutting down of huge forest areas, better known as Hambach Forest, which was cleared by 90%. On January 17, 1984, the first lignite was mined.

With an approved maximum minefield size of 8,500 hectares, Hambach is the largest lignite mine in Europe.

According to RWE, approximately 4,500 million tons of lignite were stored at a depth of up to 500 meters as of the beginning of exploitation of the field.

In the early 2010s, approximately 1,800 million tons of lignite were still available for mining, and approximately 40 million tons of lignite were mined annually from the area.

Mined lignite is transported by the Bergheim-Auenheim railway, being distributed to the Neurath Power Station, Niederaussem thermal Power Station, Frimmersdorf Power Station and other RWE consumers. With an installed electrical capacity of 4,4 gigawatts, the Neurath Power Station is the largest power station in Germany and the second largest lignite-fired power station in Europe after the Bełchatów Power Station in Poland.

Investment in lignite mining in the Rhine area continues to play a significant role in providing the German economy with cheap electricity, which is especially important in the context of the energy crisis and shortage of pipeline gas.

Tagebau Garzweiler

Tagebau Garzweiler (Garzweiler surface mine) is a lignite mine owned by RWE Power in the lignite mining area of the North Rhine.The mining area stretches between the towns of Bedburg, Grevenbroich, Juchen, Erkelenz and Monchengladbach in North Rhine-Westphalia.

This large investment project dates back to the first half of the 1960s. The Garzweiler I open pit was established in 1983 by merging the Frimmersdorf-South and Frimmersdorf-West deposits. In 1995, the state government of North Rhine-Westphalia approved the Garzweiler II lignite plan.

According to geological estimates, Garzweiler II has reserves of 1.3 billion tons of lignite. We are talking about lignite originated from ancient forests and swamps that arose in the bay of the Lower Rhine.

The geology of the Lower Rhine Bay is characterized by long subsidence of the soil during the last 30 million years, which led to the deposition of lignite layers up to 100 m thick.

This is one of the largest investment mining projects in Germany, which plays a huge role in the development of the local thermal energy sector. Most of the lignite mined in Tagebau Garzweiler is burned in large thermal power plants in the region. The transportation of lignite to the Neurath Power Station takes place mainly by railways.

Tagebau Welzow-Süd

Tagebau Welzow-Süd is an open-pit lignite mine in the southern part of Lower Lusatia in the Spree-Neisse area, operated by Lausitz Energie Bergbau AG.In the west, the mine borders on the town of Welzow, which gives it its name, and in the east the already recultivated areas border on the town of Spremberg. Up to 20 million tons of lignite are mined every year in the Welzow-Süd mine.

Lignite mining in this area has a long history. The Clara I Welzow mine began mining lignite on the Welzow Plateau in 1866. In 1957, large investments were made in modern mining, after which the first work on clearing and leveling the pit began. The first lignite was mined in 1966, after which production was constantly increased due to the exploration of new beds and the implementation of new engineering solutions.

However, in the 2010s, lignite mining in the area faced significant opposition from the local community, which led to some restrictions.

Tagebau Welzow-Süd is the main supplier for the Schwarze Pumpe power station and for the Schwarze Pumpe briquette factory. The operator LEAG is now the largest employer in Lusatia. Vattenfall, the previous owner of the business, directly employed around 8,000 people in lignite mining, processing and power generation in 2010.

Tagebau Inden

Tagebau Inden, owned by RWE Power AG, is located in the Rhine lignite mining area near Inden, between Eschweiler and Julich.The annual production is 22 million tons of lignite which is used exclusively to supply the Weisweiler thermal power station.

The Inden open-pit mine has lignite reserves of about 400 million tons that can still be mined. The thickness of lignite beds in this area reaches 45 meters. Mining takes place with the help of multi-bucket excavators. It is expected that the deposit will be exhausted by 2030.

This mining project was opened in 1957 by the lignite and briquette company Roddergrube AG.

Back in 1959, about a million tons of lignite were mined for the power plant in Weissweiler.

As with all large-scale mining projects, the extraction of lignite has resulted in the abandonment of some villages and the relocation of residents. The population has resisted at times, but pit operators still see resettlement as inevitable because lignite mining serves a public good. In some cases, new settlements are founded that contain the name of the old settlement or a combination of names, such as Inden/Altdorf.

Currently, the mine creates about 850 direct jobs.

Kaliwerk Zielitz

Kaliwerk Zielitz is a potash mine and associated processing plant near Zielitz in Saxony-Anhalt. It is the largest potash mine in Germany and one of the largest facilities of this type in the world.The history of potash mining near Zielitz began in 1960 with the drilling program to explore the Scholle von Calvörde potash deposit. In 1963, the decision was made to build the potash processing plant, and a year later the symbolic ground-breaking ceremony marked the start of sinking the first shafts above the largest deposit in the German Democratic Republic.

In 1968 the state-owned potash processing plant "Ernst Schneller" in Zielitz was founded. Annual production in 1989 was about 7.4 million tons. In the same year, the 100 millionth ton of salt was mined. After the fall of socialism in 1990, the enterprise was reformed, and Zielitzer Kali AG was founded on its basis.

This company is now part of K + S KALI GmbH, which was formed in 1993 after the merger of potash mines.

Kaliwerk Zielitz has four operating mines built between the 1960s and the 1990s. Thanks to significant investment and modernization, in the 2010s the plant produced around 12 million tons of potassium salt annually, which corresponds to approximately 30% of the total annual production of K+S KALI GmbH. By the mid-2010s, the company produced 300 million tons of potassium salt.

Salts containing potassium are used mainly for the production of mineral fertilizers and animal feed. About 2 million tons of final products are produced annually from 12 million tons of crude salt and exported worldwide.

This makes the facility one of the largest in the world.

The mined salt is further processed at the company's own factory. About 90% of finished products are transported by train on the Magdeburg-Wittenberg railway line. Kaliwerk Zielitz has its own gas-fired thermal power plant, which covers 65% of the electricity and steam needs for the above-ground production and drying systems.

In 2016, the Zielitz potash processing plant employed about 1,800 people, which makes it one of the most important employers in the region.

Steinsalzbergwerk Heilbronn

Südwestdeutsche Salzwerke AG is a well-known mining company located in Heilbronn, producing rock salt and evaporated salt.The company was established in 1971 through the merger of Salzwerk Heilbronn AG and Südwestdeutsche Salz AG. The two largest shareholders of SWS AG as of 2021 were the city of Heilbronn and the federal state of Baden-Württemberg.

In 2019, the entire group, including subsidiaries, achieved annual sales of about 290 million euros with 1,045 employees.

Salzwerk Heilbronn AG was founded in 1883 by a consortium of banks from Württemberg and Frankfurt and the city of Heilbronn and originally operated a salt mine in Jagstfeld, which was founded in 1820. In 1885, rock salt mining began in Heilbronn.

Rock salt is mined in the Heilbronn and Berchtesgaden mines, brine in the Bad Reichenhall area. The further processing and refinement takes place in the saltworks in Bad Friedrichshall and Bad Reichenhall.

The production capacity of the two shafts near Heilbronn is around 4 million tons per year. SWS AG products are sold under the Bad Reichenhaller and Aquasale brands.

The list of the largest active mining projects in Germany also includes Steinsalzbergwerk Bernburg (salt), Tagebau Nochten (lignite), Tagebau Jänschwalde (lignite), Tagebau Vereinigtes Schleenhain (lignite), Salzbergwerk Borth (salt) and other mining facilities.

ESFC Investment Group offers long-term financing for mining projects in Germany and other European countries, including investment loans, project finance instruments, and loan guarantees.

We also provide our clients with financial engineering and consulting services.