After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

According to the World Bank, business financing using bank loans should play a decisive role in the recovery of the global economy after a devastating pandemic and give companies a new impetus.

Bank loans fill niches and stimulate the implementation of investment projects in areas where the private investor does not want to interfere.

They fuel large strategic projects, providing businesses with quick access to finance.

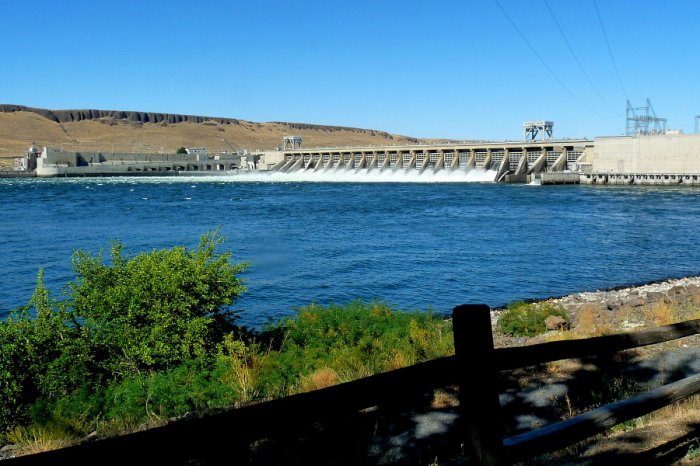

The international company ESFC Investment Group finances the following projects:

• Wind farms and large solar power plants of all types.

• Combined cycle thermal power plants and other conventional energy facilities.

• Construction and modernization of industrial facilities.

• Mines, quarries, mining and processing plants.

• Capital-intensive commercial real estate.

• Large infrastructure facilities.

• Environmental projects, etc.

If you are looking for a long-term investment loan on favorable terms, contact the ESFC finance team and outline the details of your project.

We finance large businesses, providing funds for the construction of industrial, infrastructure, energy facilities around the world.

Bank loan as a basis for debt financing

The economic activity of a company can be financed by capital coming from various sources.Capital, along with labor and land, is the basis for the development and survival of any business. It defines the limits of economic freedom of business entities and their investment opportunities. Considering the sources of capital, we can divide it into equity and debt capital.

Equity capital comes from internal sources (for example, from retained earnings) and from external sources (issue of shares).

Debt capital comes exclusively from external sources, such as loans, debt issuance or funds raised through financial leasing.

Effective commercial and investment activities are virtually impossible without the periodic use of debt financing. The need of large business for lending can be explained by both general economic reasons and some specific needs arising from the implementation of projects.

Reasons for using bank loans by businesses include:

• Time gap between the movement of goods and funds.

• Inconsistency between receipts and expenditures in some transactions.

• The complexity of forecasting the company's need for working capital.

• Seasonal fluctuations in production and sales of products.

• The need to implement large investment projects.

• Other features of a specific business.

The backbone of the global economy is now considered to be industry, agriculture and the service sector.

Growing competition in all these areas has led to an increase in demand for debt financing. The implementation of large investment projects, the introduction of new products, services and innovative technologies gives a competitive advantage, but such activities require knowledge, experience and, most importantly, large investments that exceed the resources of the business.

Businesses are often forced to use debt financing sources such as bank loans.

Long-term loans enable companies to remain highly competitive and effectively address the various challenges posed by a dynamic globalized market and its participants.

The essence of bank lending

Loans are the most common form of debt financing for all business entities.They play an important role in stimulating the economic activity of all market participants.

For business entities deciding to take on financial obligations for investments and for business expansion, the main issue is knowledge of the range of banking financial products.

Banking law defines, among the many types of activities typical for banks, business lending, issuance and confirmation of bank guarantees, as well as opening and confirmation of letters of credit, transactions with checks and bills. These actions can be carried out exclusively by banks, their branches or other financial institutions.

Commercial banks can issue business loans to any business entity that meets the established credit criteria and is considered sufficiently reliable financially and legally.

Credit relations between the bank and the borrowing company are governed by credit agreements, which determine the obligations of the parties and the responsibility for their violation. The terms of the loan agreement cannot be changed unilaterally, but in fact are the subject of negotiations (for example, in the case of restructuring a previously received loan).

A properly executed loan agreement is not only a powerful instrument for financing the current activities of large businesses, but also a source of investment financing.

The role of loans in financing large businesses

Bank loan is considered one of the oldest economic categories, and experts call lending the heart of commercial banking.For centuries, banks have financed businesses lacking free money. As a result, companies of all types and sizes can pay off their debt obligations and make investments on an ongoing basis.

Lending activities of banks are carried out through the use of money placed by other clients. Thanks to these funds, banks can provide loans for various purposes at an affordable price, which often influences the decision of entrepreneurs to use this simple source of financing.

The main functions of business loans in the economy are listed below:

• Emission function. Each new tranche provided to a business contributes to the introduction of new money into circulation, while when the enterprise repays a loan, cash is withdrawn from circulation. Thus, the money supply, adapted to the needs of economic development, determines the success of economic policy and global economic growth.

• Redistribution function. This means that bank loans can be provided to businesses through, for example, household savings in deposit accounts. This contributes to the most rational redistribution of funds that work for the economy.

• The income function means that, thanks to borrowed funds, companies can finance the current activities and development of large investment projects, which should lead to an increase in their income.

• The control function is directly related to the strategy of the lender. Credit policy is determined by economic priorities set by the bank's board and long-term plans related to its operations.

The above functions form the basis for understanding the essence of debt financing of a business in the banking market.

Currently, business loans remain one of the most demanded forms of debt financing of economic activity and the engine of the world economy.

Numerous European studies conducted in the 2010s show significant differences in the attitude of SMEs and large corporations to bank loans. Young, slow-growing companies operating in small cities and countries with high inflation and low GDP per capita need more loans than others, but they rarely turn to banks due to serious risks.

Companies applying for business loans are, on average, older, they are larger and grow faster, they usually have an external auditor and experienced top management. Most of these companies are based in large cities and countries with low inflation and fast GDP growth.

Large companies have more market power, which they use to build and maintain relationships with banks.

As a result, large companies, which may refuse to finance in the banking market in favor of issuing debt instruments, still use bank loans.

In general, firms with better financial health use more external funding. Larger and more experienced businesses, as well as companies from the industrial sector, are more likely to get access to long-term bank loans compared to small and medium-sized businesses.

Bank investment loans for large projects

Investment loans are issued by banks for companies for specific purposes that serve the development of business.This can be a modernization of a production line and even large investment projects such as the construction of a power plant or a new factory.

Conditions for obtaining an investment loan

Due to the fact that the bank transfers large amounts of money to enterprises with a high degree of risk, the decision to issue an investment loan depends on many conditions.The vast majority of banks will only consider applications from companies that have been on the market for at least 1-2 years. The application is a key document, since on the basis of the documents contained, the bank will determine the reliability of the applicant.

The most important points are the exact amount of the borrowed funds and the purpose for which the funds are intended.

This means attaching a carefully prepared business plan to the application, which should convince the bank of the feasibility of the project.

As a rule, bank investment loans for large projects are issued for a long term, reaching 15-20 years.

To obtain such financing, the company must provide adequate collateral and its own contribution, usually amounting to 10 to 30% of the planned investment costs.

The business plan should contain a detailed description of the project, including all the components necessary for the effective implementation of the investment, the original project plan / schedule, benefits and risks. First of all, the business plan should include an estimate of all costs associated with the investment. The estimate should include information on the amount of own contribution to the project, indicating the seriousness of the applicant's intentions.

ESFC Investment Group finances up to 90% of the cost of large investment projects, providing clients with flexible financing for a long time.

In many cases, in order to take advantage of an investment loan, the borrower needs to attract guarantors. If you do not have sufficient collateral, check out the offers of banks that issue loans against guarantees. It is a very effective tool to support companies with a positive credit history.

Any property of the borrower, assignment of receivables under concluded agreements, etc. can be used as security for an investment loan.

After submitting an application, the bank conducts a comprehensive analysis of the current situation of a potential borrower, carried out by analysts on the basis of the documents provided.

The decisive factor is the assessment of the applicant's creditworthiness, that is, his ability to repay the loan.

Advantages and disadvantages

The advantage of a bank investment loan is the ability of the borrowing company to attract significant financing in a short time, which plays a key role in the implementation of large investment projects in the early stages.Depending on the resources of individual banks or consortia (syndicated loans), the loan amount can reach billions of euros, disbursed within a short time.

Of course, such financing opens up fantastic opportunities for large companies, helping to outstrip competitors in strategic areas and implement global projects unthinkable without borrowing.

Since an investment loan can be taken for a period of 15-20 years or more, companies can use the future cash flows generated by the project to pay off debt obligations. In addition, the terms of the loan can be tailored to the needs of a specific project through negotiations with a financial institution. In particular, it is possible to provide grace periods in case of financial difficulties.

The disadvantages of a large investment loan stem from the high credit risk that invariably accompanies long-term capital-intensive projects.

Such a disadvantage can be a long processing of a loan application, as well as a large number of documents and high requirements for the borrower.

Some companies may have problems providing credit guarantees, collateral, or making their own contributions. We are ready to help you solve these issues.

Working capital loans

Working capital loans are a special type of bank loans designed to cover a company's need for cash to carry out its day-to-day activities, including paying salaries to employees, purchasing fuel and raw materials, repairing equipment, and so on.These bank loans allow large businesses to maintain liquidity. In most cases, these are short-term financial products with a maturity of no more than one year. Banks provide entrepreneurs with an overdraft or flexible credit account and do not always set a strict repayment schedule.

Bank working capital loans for large businesses are mainly issued in the form of short-term loans, although these can be medium-term products with a debt maturity of up to three years.

Loans can be provided in national or foreign currency, depending on the offer of a particular bank.

There are so-called revolving and non-revolving loans, the essence of which is described below. A special type is a working capital loan with a de minimis guarantee, which is provided to SMEs.

The final loan agreement includes all conditions arising from negotiations with the bank.

Each contract must indicate the cost of the financing provided. It is important that representatives of the borrowing company review the document to avoid the inclusion of undesirable additional costs, especially in the case of late fulfillment of obligations.

Credit risk

The bank, as the supplier of capital, assumes the credit risk associated with the possible bankruptcy of the borrowing company.Not every firm applying for a working capital loan can quickly obtain such financing.

Companies must have adequate funds flow in their bank account in order to be able to repay a loan. Large companies with a developed network of contractors, in general, are much more likely to get borrowed funds. Timely payments from partners are of great practical importance when evaluating a borrower. It should be noted that the bank analyzes the state of the borrower's accounts throughout the entire lending period.

Large commercial banks offer working capital loans to companies that have accounts with these banks (or undertake to open them) and demonstrate high rates of creditworthiness and financial stability.

The bank's specialists assess, among other things, the financial performance of the company, the scale of commercial activities, the availability of assets, the degree of risk of the activities carried out and other indicators that are related to the client's solvency.

Some features of the working capital loan are given below:

• Short maturity (usually less than a year). *

• Financing the day-to-day activities of the company.

• Lack of strict repayment schedules (monthly or quarterly).

• The loan can be revolving (money is used repeatedly, partial or full repayment causes its renewal) or non-revolving (used once, partial or full repayment).

* - The repayment period of the revolving working capital loan is up to one year, and in the case of a non-revolving working capital loan, the financing period does not exceed three years. Depending on the bank's proposal, the term may be extended, but this is not a common practice for European banks.

Advantages and disadvantages of a working capital loan

The main advantage of a working capital loan is to increase the financial liquidity of the company.The offers on the financial markets allow you to choose the terms of lending, which depend on the results of negotiations with the bank's representatives.

The funds provided under the working capital loan are used to cover liabilities arising from the day-to-day activities of the company. However, it is the borrower who decides when to apply for funds. Thus, the company can use the borrowed funds as needed.

As for the disadvantages, working capital loans are considered a risky financial product, therefore banks scrupulously study the history of the borrower.

They can also request financial statements, documents from the tax authorities and other documents for assessing solvency and credit risk.

The cost of a working capital loan is high. Apart from the fact that banks charge a commission, the APRC for short-term loans is one of the highest (on average 10% and more). The commission varies depending on the offer of a particular bank, and some institutions charge a processing fee.

Cost of business loans

Entrepreneurs looking for financial support for their business most often choose loans.They allow borrowers to make the necessary purchases or implement projects, the cost of which exceeds the capabilities of the enterprise.

An important factor that should be considered when deciding on lending is the cost of the loan funds.

It's not just about the nominal interest rate.

When analyzing long-term loans, APRC (Annual Percentage Rate of Charge) is extremely important. This is a more complex parameter that also applies to other loan-related costs and therefore goes beyond the nominal interest rate.

Interest is the main component of the loan.

Each bank sets the interest rate on the loan on an annual basis, and this rate is usually linked to various national or international indicators.

Additional loan costs may include, for example, an origination fee. This fee can be added to the first payment or included in the monthly (quarterly) payments.

Another important cost item is the application processing fee, which is charged once for processing a loan application. Banks generally do not refund this fee, even if the financial institution has decided to deny the applicant the money.

Credit insurance is another component that is present in many loan agreements today. Insurance depends on the bank's decision, as it is a guarantee for the financial institution in the event of a breach of debt obligations.

The bank can offer the borrower a decrease in the interest rate if he insures the loan.

However, this is not always beneficial, as the cost of the loan may increase and exceed the potential benefit from such an offer.

Factors affecting the cost of a loan

The total cost of a loan is determined by many factors.One of the most important factors is the debt security that the company can provide.

The Bank pays special attention to security, since it thereby guarantees the return of the funds provided in the event of a business project failure.

Another factor is the creditworthiness of the borrowing company. This is a comprehensive assessment, which is carried out on the basis of an analysis of the documents provided and our own research carried out by the bank. The elements of analysis include, but are not limited to, credit history and customer income.

In addition, several additional factors are taken into account.

These include, for example, the purpose of the loan, as well as the economic situation of the country. In this context, inflation, competition in the banking market, unemployment and the level of interest rates are important.

Assessment of the borrower's creditworthiness

Banks, as suppliers of banking products that constitute the main source of their income, try to adapt their offer to the growing needs of customers, including borrowers.Financial liabilities provided to companies and individuals in the form of loans are one of the main activities of banks.

In this context, creditworthiness is of great importance, that is, the ability of the borrowing company to repay the loan together with interest within the terms specified in the agreement. Adequate creditworthiness is possessed by those companies whose financial condition and level of financial efficiency of economic activity ensure the fulfillment of obligations not only to the bank, but also to all creditors.

Banks, providing loans to business entities, have complete freedom in assessing creditworthiness. These criteria depend both on the bank that provides the loan, on the type of the loan itself, and on the profile of the potential borrower who has applied for financing.

Credit factors include the following:

• The value of the company's assets.

• Organizational structure of the business.

• Capital structure and funding sources.

• Competitiveness of the company and its products.

• Current and expected financial performance.

• Experience and qualifications of management personnel.

• Local and regional market factors.

• Macroeconomic factors, etc.

In almost every case, the bank analyzes factors of both quantitative (measurable) and qualitative (immeasurable) nature, the complex result of the assessment of which will depend on the individual approach and the assessment criteria adopted by the bank.

Depending on the bank, the borrower may face a restrictive or liberal approach (to the extent permitted by law). Managers make decisions based on current credit policy. It depends on whether the bank needs to attract new credit clients, whether it has enough funds, etc.

Restructuring of bank loans

Restructuring a loan is a change in the terms of its repayment. It is used when the borrower has problems paying off the obligation.The restructuring is aimed at improving the client's financial position, while at the same time helping to return to the timely payment of financial obligations.

The loss of financial liquidity can affect even large companies, especially against the background of the implementation of large investment projects, as well as in conditions of political, economic instability and other unpredictable global factors.

Restructuring of bank loans provides for changes in conditions and their adjustment in accordance with current business opportunities. In particular, the bank may change the repayment schedule, which is usually accompanied by an extension of the debt repayment period. On the other hand, the total cost of the loan for the borrower also increases.

In this simple way, banks support clients who are struggling to pay off their debt, and at the same time generate profit in the form of increased value.

Situations requiring loan restructuring

A business should think about restructuring as soon as possible when the first problems arise with the regular payment of obligations.In this way, the consequences of delay can be prevented.

Banks most often agree to restructuring in the following cases:

• The income of the borrowing company has decreased significantly. This problem is especially true for large investment loans with a long maturity, when the success of an investment project depends on many factors.

• Temporary problems with financial liquidity. Sometimes a company's unexpected spending poses a threat that requires restructuring while the business recovers its financial health.

• Force Majeure. The consequences of some local events and global crises, such as a pandemic or an increase in geopolitical tensions, can affect the financial condition of borrowers and jeopardize their projects.

It is important to resolve the issue of restructuring a business loan through a deep and comprehensive analysis with the involvement of highly qualified financial consultants.

Negotiations with the bank, supported by a well-drafted loan agreement, form a solid basis for a possible debt restructuring in the future.

Options for restructuring a bank loan for a business

The bank can restructure a business loan by changing the debt repayment schedule, adjusting the interest rate, providing grace period or by other means, depending on the agreements reached.Table: Debt restructuring methods.

| Restructuring methods | Short description |

| Changing the schedule | The change in the repayment schedule is to extend or shorten the term of the loan. In the first case, the number of payments increases, which means that their size decreases. It is important to understand that as a result, the total cost of the loan increases. When the term of the loan is shortened, its cost decreases. |

| Interest rate change | This method is a change in the established margin, which is the bank's profit. If the lender agrees to such an offer, the interest rate is reduced and the monthly payments are lower. |

| Loan currency conversion | Conversion is a complex, potentially profitable, but rather risky operation, which consists in changing the currency of the loan. Risks accompanying the conversion are associated with fluctuations in the exchange rate. |

| Credit holidays | The postponement of the loan maturity can give a kind of respite to the business in difficult situations. In other words, the company does not need to pay the loan for a certain period of time, but interest continues to accrue. |

| Balloon payments | Balloon payments are based on converting fixed payments into incremental payments. Thanks to this procedure, it will be possible to make small or even zero payments from the moment of restructuring. Later, however, these costs will level out and the final payments will be significantly increased. |

| Sale of collateral | Some banks offer the option of selling assets or liabilities, which can lower the payments and make it easier to pay off debt. |

Business loan restructuring is gaining popularity and is increasingly featured in bank proposals.

Banks do not discourage customers whenever possible, but this procedure requires careful planning and preparation.

The financial team of ESFC Investment Group is always ready to help large business in matters of bank loan restructuring and refinancing.