After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

Unlike commercial real estate, where there is one single goal (selling goods), industrial real estate meets a wider range of needs that investors benefit from.

This property includes warehouses, workshops, data centers, research facilities, energy facilities and more.

ESFC Investment Group, a Spanish company with international experience, has extensive opportunities in financing large investment projects.

We offer long-term loans for the construction and purchase of industrial real estate, as well as provide financial modeling, financial engineering and consulting services.

Contact our representative for more information.

Basics of investing in industrial real estate

Since the end of the 20th and the beginning of the 21st century, investment in industrial real estate at the international level has been dynamically developing and has become an increasingly important element in the portfolios of many investors around the world, including developing countries.The transformation in the industrial real estate markets has taken place both geographically and structurally.

Industrial real estate is expanding its presence in the capital markets in the following ways:

• Most companies whose shares or bonds are traded on the capital markets invest part of their assets in attractive assets, including industrial facilities.

• Specialized state funds or companies appear, the main focus of which is investment in real estate, and their shares and bonds are traded on the capital markets.

• Many institutional investors invest in industrial assets as part of portfolio diversification.

Real estate as an asset includes land along with everything that is permanently adjacent to it, including buildings, workshops, electrical grids, pipelines and other objects structurally connected to the land. The real estate market is grouped into several main categories depending on the use of real estate.

Industrial real estate in this respect includes specific groups of assets used in production processes. Industrial facilities may be freestanding or part of an industrial park and may be occupied by one or more tenants. Owning industrial real estate is the foundation for achieving stable and predictable profitability.

Industrial facilities can be divided into the following types:

• warehouses;

• transport hubs;

• light industry buildings;

• heavy industry buildings;

• energy facilities;

• research buildings;

• offices or multifunctional premises.

The main advantage of industrial facilities is the shorter construction time, which allows faster response to market changes.

For this reason, redevelopment is rare in this type of property.

Industrial real estate development is a complex process that transforms a land plot into a building through the rational use of land, labor, materials and financing. Real estate development, unlike most other production processes, takes a significant amount of time (for example, planning, designing and building a thermal power plant can take about 2-3 years).

The real estate development process goes through several main phases:

1. Identification and survey.

2. Research and evaluation.

3. Land plot acquisition.

4. Design and budgeting.

5. Obtaining permissions.

6. Entering into a commitment.

7. Implementation of the project.

8. Leasing / management / disposal.

A key element of the investment process is project financing.

Ideally, project initiators at this stage should provide capital providers with a package of technical and financial documentation, obtain permits for the construction of an industrial facility.

In this way, potential project participants will be protected from the main risks and confident that the initiators intend to continue the development of the property. As a rule, this requires a certain financial contribution of the project initiators, usually at the level of 10 to 30% of the project cost.

Two main types of debt financing are used in the development of industrial real estate:

• Short-term financing: the purpose of this financing is to provide the necessary short-term capital to cover the current costs of construction and equipment of a particular project.

• Long-term financing: The purpose of this financing is to provide the necessary funds to maintain the entire investment project, including after its completion. Without of long-term financing, the building contractor will be forced to look for a buyer for the object immediately after its construction in order to repay the debt.

It is also possible to arrange long-term financing through so-called forward financing.

This is a preliminary agreement to purchase the project when it is completed and fully leased. In this case, financial institutions provide all the necessary funds for the construction and equipping of a particular industrial facility under the financial guarantee of the construction contractor.

The entire risk of construction lies with the developer, and in case of failure, financial institutions take over his role and act as developers until the completion of the project. Because they have to share some of the entrepreneurial risk with this funding, they will expect higher returns on their investments. This means that the cost of financing will be higher.

Industrial real estate construction can be financed by financial institutions through temporary equity, pre-purchase, lending, bond purchases, leasing instruments, and so on. Project finance mechanisms through the establishment of a special purpose vehicle (SPV) are becoming in demand for large industrial projects, since project debt service is entirely based on the future cash flows of a particular investment project.

This provides numerous benefits to project initiators.

Our company specializes in organizing project finance schemes for industrial projects in the field of oil and gas, energy, heavy industry, chemical industry, ferrous metallurgy, mechanical engineering, food industry, waste processing and a number of others.

Financing of investment projects in industrial real estate

In the development of industrial real estate, entrepreneurs often use external sources of financing.The volume of external financing largely depends on the motivation of the construction contractor and the current market conditions. Debt financing is usually provided by large commercial financial institutions, primarily banks.

Debt financing for the development of real estate projects is divided into short-term financing and long-term financing. Short-term financing is used to cover the costs that accompany the production process during the business period, such as the cost of land, construction costs, wages of builders, etc. Long-term financing allows the developer to refinance part of the production costs, including short-term loans during development industrial project.

In many cases, investments in industrial real estate are financed through a combination of the developer's internal capital and borrowed funds.

By providing a loan, financial institutions become partners in investment and demand returns in the form of interest and service fees for the risk they take. This return should cover their risk premium and expected return on investment.

Forward funding for industrial real estate

Forward funding includes an agreement between a developer and a financial institution or financial investor (such as a pension fund) in which the capital provider is required to provide short-term funding during the development period by acquiring a share of the property after it is put into use.The terms of such financing are negotiated either in the initial phase of the entrepreneurial period, or at a fairly early stage of its development.

Forward funding reduces the risk of the building contractor, since, on the one hand, the terms of sale of the finished building are agreed in advance, and on the other hand, the result of the project and the return on investment are guaranteed by this contract.

From the perspective of a financial institution, the benefits of forward funding include:

• Achieving higher real estate returns through lower acquisition costs (the capital provider agrees to take on more risk in exchange for more returns).

• During the period of operation of the facility, the rent may increase, which will affect the increase in the income of the institution.

• By entering an investment project at an early stage, a financial institution can influence the design and selection of tenants.

When organizing forward funding schemes, the parties proceed from such parameters as capital value, net operating income, basic rent, investment costs, net development value (NDV) and other important parameters. All this is important to analyze at the initial stage of the project.

Long-term bank loans

Forward funding is mainly possible for large and expensive industrial properties with high investment potential.However, such facilities represent a very small part of the market. In addition, large projects require syndicated funding from a consortium of institutions, further complicating forward funding negotiations. For these reasons, bank loans are by far the most common form of debt financing, filling the gap between equity capital available and project cost (development costs).

There are different types of bank loans.

Short-term financing for the construction of an industrial facility is often provided through short-term revolving bank loans, an overdraft facility or a line of credit.

These loans are renewed after the start of construction of a new project by the developer. They are usually secured by the pledge of other assets of the developer, as well as the assets and cash flows of a specific investment project.

Banks may require the following collateral and guarantees when financing industrial real estate:

• Collateral of project assets to be funded.

• Other property, if the value of the project assets is insufficient.

• Sufficient funds in the bank accounts of the borrower.

• A lien on receivables from a lease or sale.

• A corporate guarantee from a parent company or other related company.

• A guarantee from the owners of the company to the level of individuals.

• Obligations to the co-debtor by the parent company, related company or owners.

• Bank guarantee from another bank.

So-called mezzanine financing for industrial real estate investment projects is also common.

It is used when the developer is unable to secure sufficient equity capital required to acquire land, order engineering services, and obtain a building permit. After the building permit, the loan agreement has already been concluded, i.e. a bank loan secured by the first pledge of land and the right to construct a building under construction on it.

Mezzanine financing is a hybrid of debt and equity, which is an unsecured loan that supplements the required equity of the borrower.

This is discussed at the same time as securing a loan for a particular project. A feature of mezzanine financing is that if the debt is not paid on time, it is converted into equity or share capital. In this case, the capital provider becomes a co-owner of the project.

Larger companies that have a portfolio of real estate and various projects use corporate loans in addition to overdrafts or lines of credit. Corporate loans take into account the entire activity of the building contractor, not just the current project.

Thus, the bank minimizes its risks by guaranteeing a bank loan with the borrower's assets and project cash flows and, possibly, other property or assets.

The bank's corporate clients are usually served by a single team for each loan, which supports both the bank and the borrower. The bank periodically monitors the current status of its corporate clients, which simplifies and increases the efficiency of the approval of new loans. Corporate loans usually have moderate interest rates.

Project finance

An alternative to corporate loans are project loans (project finance).They represent a bank loan that finances the development of a particular industrial project.

The percentage that banks finance varies depending on the quality of the developer and his project. It is usually 75-90% NDV. The rest of the cost of the project is provided by the project initiator or construction contractor, which motivates him to complete the project. It is often required that a portion of the developer's equity capital has already been invested before the bank will issue a project loan.

Participation in industrial development projects or the purchase of large land plots is very often carried out by creating a special purpose vehicle (SPV).

Such indirect investment in real estate through the purchase of project shares / SPV shares is widespread in a number of countries. The benefits of this practice are numerous, including minimizing the costs of acquiring and managing real estate, as well as diversifying risk.

Project finance is based on the cash flows of a specific investment project, so a comprehensive project assessment plays a key role in the structure of the PF.

In addition to the detailed analysis of the project, which is of paramount importance for the financial decision of the bank, the developer also provides historical financial statements, both its own and the parent company, if any.

An obligatory element of debt financing is the planning of predictable and reasonable cash flows from the moment the agreement is concluded until the full repayment of the loan.

The financial stability and experience of the developer are also factors that facilitate debt financing negotiations.

Financial institutions usually hire external experts who prepare professional analyzes of industrial real estate projects. They also conduct a very detailed risk analysis of the project, developer and market. Their goal is to make sure that the valuation of the project and the profit from it provide sufficient risk coverage for the investor, bank or financial institution.

ESFC Investment Group has been specializing in the organization of project finance schemes for large projects for a long time.

We offer customized financial models and advanced solutions for projects in heavy industry, mining and processing, oil and gas industry and other areas.

Main types of investors in the industrial real estate sector

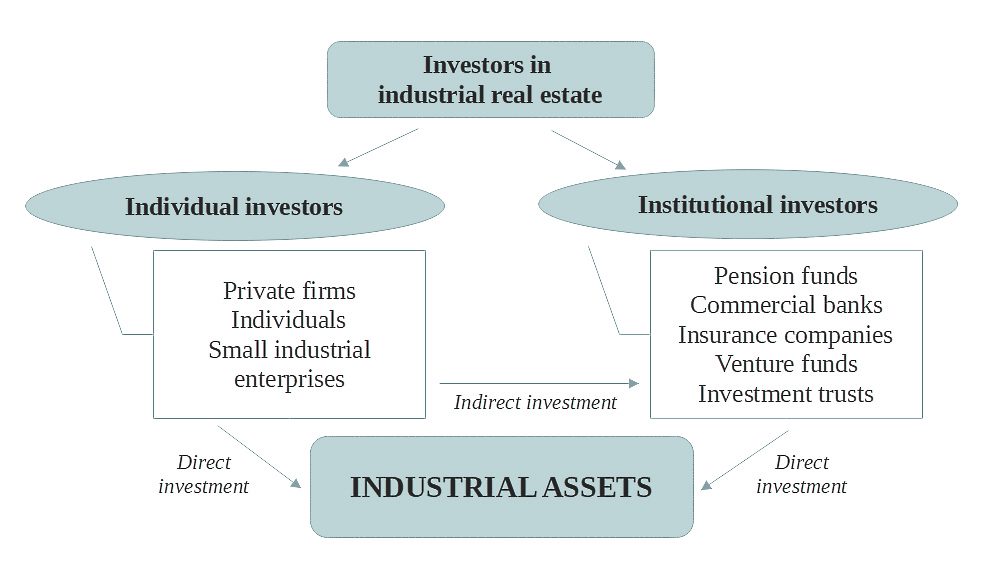

Experts offer the most accurate distinction between individual investors and institutional investors, according to their type, mode of action, role in the investment process and the goals they pursue.Individual real estate investors are predominantly entrepreneurs who invest equity and debt in real estate for the purpose of increasing capital and for personal gain.

Institutional investors, on the other hand, have a collective form and are usually managed by a team of professionals who specialize in investment activities. They usually operate with large capital, which allows them to carry out capital-intensive investment projects in the field of industrial real estate without the use of debt.

So-called individual investors own a small share of industrial real estate.

Because they usually have more limited financial resources to invest, this type of investor relies on bank loans.

For this reason, their decisions to purchase and build a new workshop or warehouse are highly dependent on the availability of funding from a bank or other source.

Higher debt risk (high leverage) means that individual investors also tend to take on more risk.

Individual investors, in some cases, make investments by purchasing the services of professional advisors or investment intermediaries, called asset managers.

Asset managers act on behalf of their clients and seek to increase portfolio returns through effective portfolio management. In exchange for professional services, they charge their clients an annual fee, which is usually calculated as a percentage of assets under management or profits generated.

The term "institutional investors" can be defined as companies that carry out investment activities with capital provided to them for management by their shareholders or contributors. The goal of investing in industrial real estate for this type of player is to achieve a certain rate of return on the capital of shareholders or investors.

The object of investment can be both securities of industrial enterprises, and directly real estate and related assets.

Institutional investors manage the capital of several shareholders / investors, united in a collective portfolio. In this they differ from asset managers who manage individual portfolios of their clients. Institutional investors must make investment decisions that benefit all of their shareholders and contributors simultaneously, while asset managers follow an individual investment strategy designed solely with their clients' risk appetite in mind.

Practice give us reason to distinguish two groups among institutional investors in industrial real estate, namely implicit investors and explicit ones. The first group includes institutional investors who focus not on investing, but on providing specialized financial services.

They accumulate capital, which has a strictly defined purpose (deposit, pension, insurance, and others). In order to keep their clients' money, they are forced to make investments that clients in most cases are unaware of.

This gives us reason to call this type of institutional investors "implicit".

Examples of this type of investor are pension funds, insurance companies, banks, and public companies.

The second group of institutional investors are "explicit" investors. Investors deliberately give their money to them for management, expecting to be invested profitably. By choosing a particular institutional investor, they directly decide what investment strategy they want to use to manage their money. Their goal is to earn higher profits, and not to use another type of financial service, such as insurance or pensions. For this reason, they tend to be at higher risk.

There are many forms that explicit institutional investors can take, including:

• investment companies;

• mutual funds;

• investment trusts;

• investment banks;

• hedge funds;

• special sovereign wealth funds;

• venture capital funds;

• business angel funds, etc.

Whether investors are individual or institutional, they differ from each other in the way they invest.

Two options are available, direct and indirect investments in industrial real estate. As a rule, direct investment is more related to institutional investors, and indirect investment is more related to individual investors, but there are exceptions in certain situations.

In direct investment, investors themselves decide in which industrial asset they want to invest their capital. They directly manage the investment process and control the spending of funds intended for this purpose. By purchasing warehouse, plant or workshop, direct investors acquire property rights and can freely dispose of them. The disadvantage of this form of investment is the high cost per unit area.

This includes both the initial (investment) costs of the property and the operating (maintenance and management) costs of the asset.

Indirect investing involves providing capital to a professional who is responsible for making investment decisions and managing the entire investment process. The owner of the capital in most cases does not have the opportunity to determine the investment strategy, since his funds are managed in a common portfolio with the capitals of other investors.

With indirect investment, the most important thing is the profitability, on the basis of which they decide with which management company to invest their funds.

Indirect investment provides an opportunity to diversify the portfolio and get shares of industrial assets that are too expensive for direct investment.

Types of industrial property ownership

Investors or owners of industrial real estate projects can be any individuals and legal entities that do not have a legal ban on the acquisition of real estate.But some countries prohibit certain individuals from acquiring ownership of certain types of real estate. Regardless of the type of investor / property owner, experts identify several types of industrial real estate ownership listed below.

Direct ownership

Direct ownership means that the person / entity who is the owner and investor is a professional in the industrial real estate market and independently manages his property.In this case, all decisions are made individually and the responsibility is also personal. This is rare in the context of industrial assets, which usually require cooperation among multiple stakeholders to run a business effectively.

It is more difficult to overcome financial difficulties in such cases, but decisions on refinancing or sale are made quickly and without additional approvals. Direct ownership gives independence and freedom to the investor, but, on the other hand, limits the opportunities for growth and diversification, which depends on the size, financial health and potential of the investor.

Private partnership

In this type of ownership, the investor delegates the management of the property to his main partner or external company, for which he must pay a certain fee.Typically, this form of private partnership is successfully used in the management of one or more industrial properties, which are often not diversified in terms of location and type of assets. In a private partnership, liquidity may depend on the financial health of the investor's partners.

Although one partner can sell its share to another partner without selling the property, this is quite difficult to do.

In private partnerships, conflicts of interest often arise between the general partner and junior partners. They are mainly related to determining the share of income of the main partner, the decision to sell or refinance property, as well as issues of personal liability of partners.

Real estate limited partnership

In its classical form, a public company does not have a majority owner.This is a joint-stock company whose shares are traded on the regulated financial instruments market (listed company).

Property management in public companies is carried out by transferring it to the board of directors or an external company. Specialized public companies that invest in real estate are also called real estate funds. This approach gained particular popularity during the global recession in early 2008, and it continues to be successfully used in industrial real estate investments as well.

In this way, investment management specialists are involved in the management of the company, which contributes to increased efficiency and significant savings in management costs.

An even more common approach to managing real estate funds is an external management company that specializes in managing this kind of investment, called an asset manager.

Management of state industrial assets is most often entrusted to specialized external companies.

There are large asset managers who, in addition to managing investments and fund portfolios, also specialize in managing industrial real estate. Public companies have access to financial investors and retail investors in the capital markets. Through securitization, they can accumulate much more investment resources than other forms of real estate management.

The scale of these funds is large, and they can invest in several large investment projects, achieving the necessary diversification by type or location of assets.

Industrial real estate investment management

The types of real estate management are understood as the organization of the owner of a particular asset, which owns investment property and, accordingly, receives income from its management.Corporate investors are usually joint-stock companies, their equivalents or special corporate funds, and in general they can be divided into professional and non-professional investors.

Non-professional corporate investors can be any joint-stock companies that invest part of their capital in industrial real estate. They do not receive their main income from this activity. The behavior of these players and the nature of their investment objectives largely coincide with the behavior of small non-corporate investors. Professional investors are the so-called investment funds, or collective investment institutions.

An investment fund is a structure where the assets of individuals or legal entities are accumulated and invested on their behalf. The contributions of multiple small investors are managed as a single portfolio in which each investor owns a share.

This approach has the following advantages:

1. Expert management: small private investors have neither the time nor the knowledge about the types of investments and procedures involved in the stock markets.

2. Diversification: there is a generally accepted rule in portfolio management that asset diversification reduces risk, but small investors cannot achieve this effectively.

3. Value: by managing many small investments through one large portfolio, economies of scale could be achieved, which in turn could be passed on to the individual investor in the form of lower costs.

4. Security: since investment funds in most countries are subject to legislation aimed at protecting the interests of small investors, the latter build a sense of security to protect and properly manage their money.

Industrial real estate investment funds are divided into corporate funds, trust funds, insurance funds, pension funds, alternative investment funds for private portfolios.

Also, depending on the principal structure, experts distinguish closed-end and open-ended investment funds.

Risks associated with investments in industrial real estate

Return and risk are at the heart of every investment project and every investment decision.Risks are usually classified into general, systemic and non-systemic, which is discussed in detail below in the context of investing in industrial assets.

Risks associated with natural disasters, social upheavals, wars, industrial accidents, environmental disasters and other emergencies are characterized as general risks. As a rule, they are minimized through the use of appropriate insurance products.

Systemic risks are a derivative of macroeconomic risks and market risk. They are associated with the macro environment in which the business operates, and therefore are not subject to management and control by its team. They affect the activity to varying degrees and manifest themselves in different periods of investment project.

Systemic risks also include those that relate to all economic entities at the national and international level and are the result of factors external to the investor, which he cannot influence. The main methods of limiting the impact of these risks are the collection and analysis of current information and forecasting the further development of the situation.

Types of systemic risks in investment activity include the following:

• Unfavorable legislative changes.

• Political and geopolitical risk.

• Credit risk depending on many factors.

• Currency risk.

• Inflation risk.

• Environmental risk.

The complexity of predicting all these risks and the impossibility of reliable insurance makes it necessary to use an accurate approach when analyzing available information, insuring industrial real estate and other assets, and developing a clear action plan in case of a crisis.

Non-systemic risks are risks directly related to the activities of the company, which are mainly dependent on management.

They are sometimes divided into two groups, namely industry risk and company risk. Industry risk is associated with the state and development trends of the industry (raw materials, technologies, competition, key performance indicators).

The company's risk is related to the nature of the main business activity, the organization of the production and technological process, the security of financial results, etc. The impact of this risk on the result of investment activity depends on the quality of management.

Its minimization is based on increasing the efficiency of internal planning and forecasting, which will make it possible to overcome the negative consequences of a risk event.

Varieties of corporate risk include business risk, liquidity risk, credit and financial risks.