After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

The most important trading partners of India are the USA, the UAE, China, and the European countries.

Thanks to successful reforms, a variety of natural resources and huge human potential, Indian economy is growing rapidly, aiming to keep a place in the top 3 largest economies by GDP (PPP) in the near future.

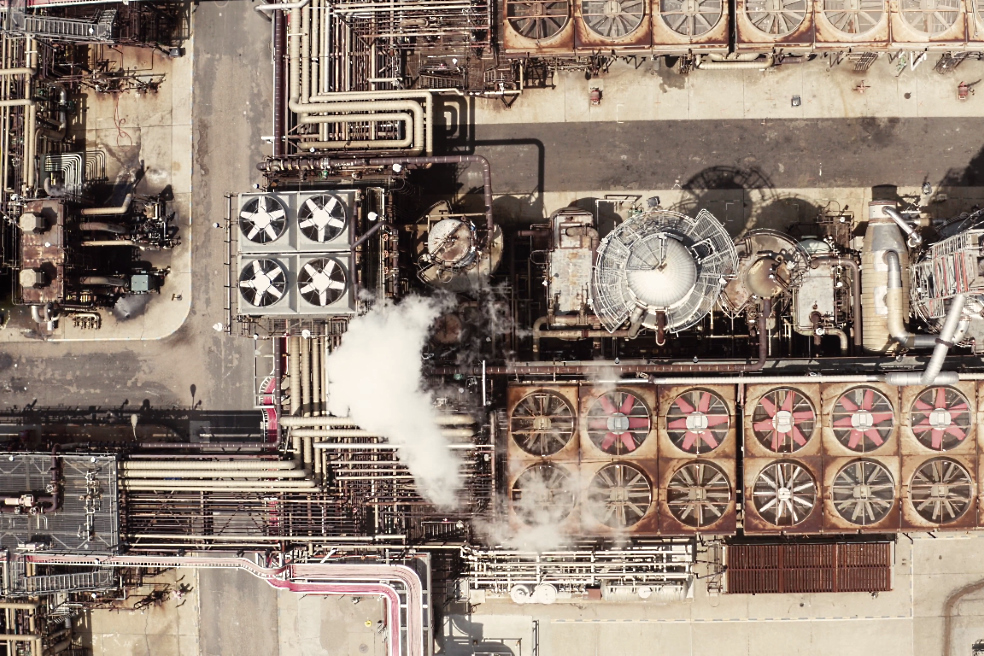

The IT industry, tourism, textile production, chemical industry, food industry, pharmaceutical industry and metallurgy are developing most actively, requiring a significant inflow of capital in the form of business loans and foreign investments.

Long-term industrial loans in India, along with land loans for developers, agribusiness lending, project finance and other forms of financing are growing, providing the young economy with the long-term capital it needs.

What to consider when planning business financing in India

India is now the world's third largest economy by GDP based on purchasing power parity.With a population of more than a billion people and young, fast-growing companies, many large investors see the Indian market as an attractive destination for international expansion. Huge investments, especially in infrastructure, logistics, energy sector, waste processing and environmental protection, are increasingly perceived as a great business opportunity.

International experts point to a high threshold for entry into the Indian market and associated risks.

In recent years, India has become much more business-friendly, as evidenced, for example, by its rise in the World Bank's Ease of Doing Business ranking.

India ranks among the best of all South Asian economies in terms of access to business loans, according to the World Bank and the International Finance Corporation. Although the country has no difficulty in accessing bank loans, bureaucracy is a serious barrier to business development in India. For example, to obtain a permit for the construction of an industrial facility, companies have to go through dozens of lengthy procedures, which can take from several months to several years.

TMF Group notes the long time it takes to register a business in India (27 days compared to the OECD average of 12 days) and about a dozen related procedures.

To get a building permit in India, you need to go through 34 procedures, which took an average of almost 200 days. On average, 1,420 days are spent on resolving legal disputes related to the performance of contracts.

The US Department of Commerce is also drawing attention to a number of measures to protect the Indian market. Average import tariffs are the highest among the G20 countries. In addition, experts advise investors and exporters to carefully plan logistics issues with proven local partners, as timely deliveries are a problem due to the peculiarities of local infrastructure, business culture and the attitude of part of the Indian administration towards foreign companies.

In addition, India's federal system often requires businesses to interact with multiple levels of government.

The entry of companies into the Indian market and the implementation of joint investment projects on the territory of this country require large funds at the earliest stages. Business development in India involves a lot of administrative procedures, so expenses can be high, and the time between a business idea and the launch of an investment project can take years.

This creates significant long-term capital needs that must be met in an appropriate manner, taking into account the type of business, market conditions, legal framework and other factors.

ESFC Investment Group is an international company with European roots, which specializes in long-term financing of large business projects.

In particular, we offer large industrial loans in India, loan guarantees, flexible project finance (PF) arrangements, letters of credit and other financial instruments to ensure the smooth development of capital-intensive businesses.

Long-term financing and business loans in India

Broadly speaking, there are about a dozen ways of business financing in India, including long-term industrial loans, large land loans for developers, letters of credit and many other instruments.Long-term loans for business

Long-term loans are the most common instrument for financing new projects in India.The typical repayment period of such loans ranges from 1 to 5 years, however, but some investment projects are based on loans with a term of up to 10 years or even more, especially when it comes to large infrastructure facilities, energy and industrial projects with a long payback period.

Such loans can amount to tens or even hundreds of millions of US dollars.

Usually, long-term business loans in India are given at a low interest rate, but the applicant should be prepared to provide adequate collateral, including in the form of project assets.

Project finance

Project finance in India has not been used for so long compared to the USA and developed economies of Western Europe, but PF has a huge potential in the context of the future development of the local economy.This refers to the financing of investment projects, in which the project itself is a source of servicing debt obligations.

When making a decision on financing, capital providers evaluate the investment object from the point of view of safety and profitability, which will ensure repayment of the loans provided. The main security under such agreements is the future cash flows of the project and the assets involved in it.

India continues to improve PF legislation to make it a more effective and attractive tool.

Business loans from commercial banks, issue of project shares, government financial support in various forms, bills discounting and other mechanisms can be used in project finance.

Loans under government guarantees

The Indian government is working on financing business projects aimed at improving the lives of the population and some local communities.It is an important mechanism for the implementation of state policy in some areas that cannot effectively develop in the environment of fierce competition.

Loans under government guarantees are usually granted to private entrepreneurs and small businesses implementing socially significant projects. However, large projects can also receive government support if they are aimed at strengthening the Indian economy, improving the lives of communities, stimulating innovation, improving human capital, and so on.

Working capital loans

Loans for working capital refer to short-term financial instruments that companies widely use to solve current financial problems. In addition to payments with suppliers, it can be the purchase of materials and equipment, the hiring of additional workers for the expansion of the enterprise, and many other purposes.Business loans to replenish working capital are mainly issued by Indian banks for a period of up to one year.

This type of loan is usually unsecured, which means that the borrower is not required to provide any collateral or guarantee to the bank. Banks also set a limit on the size of the loan and can strictly control the use of capital for specific business purposes. The interest rate on short-term loans is usually higher compared to long-term investment loans.

Letters of credit

Documentary letter of credit in India is used mainly for financing trading companies, where the bank provides a certain guarantee of financing the company in international trade agreements. This tool is used for both import and export operations.Local business chooses letters of credit as a form of non-cash payments because it is convenient, fast and safe.

The company buys currency at the exchange rate at the time of issuing the letter of credit, not at the time of payment. Months may pass between the issuance of the letter of credit and the payment. Therefore, entrepreneurs avoid any currency risks.

Table: Approximate interest rates on business loans in some Indian banks (Q3 2022).

|

#

|

Bank

|

Min %

|

Max %

|

|

1

|

HDFC Bank

|

10,00

|

22,50

|

|

2

|

ICICI Bank

|

17,00

|

-

|

|

3

|

Axis Bank Limited

|

14,25

|

18,50

|

|

4

|

IDFC First Bank

|

14,50

|

-

|

|

5

|

Kotak Mahindra Bank

|

16,00

|

20,00

|

|

6

|

Tata Capital Finance

|

19,00

|

-

|

|

7

|

RBL Bank

|

17,50

|

25,00

|

The largest banks that issue business and industrial loans in India

India has a complex two-tier banking system.The Reserve Bank of India is the country's central bank and manages the debt of the central government and state governments, holds the country's foreign exchange reserves and oversees the return of export earnings, as well as the return of capital invested abroad for domestic investments.

The Reserve Bank provides short-term loans to state governments and other banks, as well as industrial loans for major strategic projects.

One of the largest financial institutions in the country, which, among other things, finances business, is the State Bank of India, formed as a result of the nationalization of the Imperial Bank of India in 1955.

The State Bank functions as an agent of the Reserve Bank in carrying out numerous government operations and also performs purely commercial functions. The second tier of the system, commercial banks, has hundreds of registered banks, including dozens of foreign banks.

State Bank of India

State Bank of India (SBI) is the largest state-owned bank and financial services provider in India.The bank traces its origins to the Imperial Bank of India, which was known until 1806 as the Bank of Calcutta. This fact makes SBI the oldest commercial bank in the country.

In 1955, the government nationalized the Imperial Bank of India, transferring 60% of the shares to the Reserve Bank of India (the central bank) and renaming it the State Bank of India. In 2008, this share was bought back by SBI.

SBI provides a wide variety of banking products through its vast network of branches in India and abroad, including large business loans, industrial loans as well as land loans.

The State Bank Group, with more than 16,000 branches, has the largest network of bank offices in India.

SBI is considered at the same time the best bank abroad, having 130 branches abroad, and is one of the largest financial institutions in the world. With base assets of $352 billion and deposits of $285 billion, it is a regional financial giant. The share of SBI in the market of banking services in India is about 20%, and every fifth bank loan in the country is issued by this financial institution.

SBI offers a wide range of business loans, including long-term loans for SMEs with a repayment period of 60 months. When considering a loan application, the bank usually gives preference to reliable companies with an operating history of at least 5 years.

ICICI Bank Limited

ICICI Bank, headquartered in Mumbai, is an important link in the financial system of India.The bank was founded in 1955 under the name Industrial Credit and Investment Corporation of India and for several decades it dealt primarily with industrial loans.

In 1994, the financial institution was transformed into the traditional commercial bank ICICI Bank Limited. Today, the bank actively offers insurance services, which make up more than half of its portfolio. More than half of the bank's shares are currently owned by foreign investors, including Deutsche Bank Trust Company Americas.

With more than 5.2 thousand branches, ICICI Bank is widely developing its activities not only in India, but also in China, the United Arab Emirates, Indonesia, Singapore, the USA, South Africa, as well as in the EU countries and other regions. In 2021, the bank reported $215 billion in assets.

Bank of Baroda

Bank of Baroda, headquartered in the state of Gujarat, like many large banks in India, is controlled by the government.Founded in 1908, the bank quickly expanded its network beyond India, opening its first branches in England in the 1950s, as well as in African countries. Thanks to a historic merger with other Indian banks in 2018, Bank of Baroda has become one of the largest in India.

With more than 8.5 thousand branches at its disposal, Bank of Baroda had assets in excess of $160 billion in 2021. About 90% of the bank's activity is in India, but subsidiary banks in New Zealand, Kenya, Botswana and other countries are also actively developing.

The bank offers, among other things, large industrial loans and other instruments for financing local and international businesses.

HDFC Bank

HDFC Bank Limited is India's largest private bank, which is among the top 10 largest financial institutions in the world by market capitalization.With over 5,600 branches, HDFC Bank Limited has accumulated $243 billion in assets as of mid-2021. A significant part of the loan portfolio consists of business loans and industrial loans.

HDFC Bank is a relatively young bank that was founded in 1994, and in 1995 held an initial public offering on two Indian stock exchanges. In 1999, the bank merged with Times Bank. In 2008, HDFC took over Centurion Bank of Punjab and also opened its first overseas branch in Bahrain. Currently, the bank's activities are concentrated in India, and foreign activities are mainly limited to branches in the UAE, Bahrain China and Kenya, bringing a small percentage of the total revenue.

The bank actively lends to entrepreneurs, large companies from the trade sector and industrial enterprises, as well as agricultural producers.

It offers attractive loans for business development aimed at financing long-term projects.

Punjab National Bank

Punjab National Bank (PNB) is an Indian multinational bank and finance company.It is the second largest public sector bank in India, headquartered in New Delhi. As of 2020, PNB had a network of over 12,000 branches and over 180 million customers worldwide, including China, Australia, European countries and other parts of the world.

Punjab National Bank has assets of over $170 billion. Lending plays a significant role in the structure of the bank's financial activity, including long-term business lending and loans for the development of industrial enterprises.

Also, the financial institution pays great attention to mortgage loans, insurance, business loan refinancing, agricultural lending and other areas. PNB has about two dozen subsidiary companies specializing in various areas of financial activity.

Union Bank of India

Union Bank of India (UBI) is one of the largest state-owned banks that issues large loans including business loans.The bank has more than 9,500 branches and serves more than 120 million customers in India and abroad, including in China, UAE and Australia.

UBI was founded in 1919 in Mumbai. For more than a hundred years of history, the bank has earned a reputation as a reliable financial partner for both entrepreneurs and large companies. The bank actively supports SMEs and makes great progress in the development of digital technologies.

The list of major banks for business financing in India also includes the following:

• Axis Bank Limited.

• Kotak Mahindra Bank.

• Standard Chartered.

• Canara Bank.

• Bajaj Finserv Loan.

• Bank of India.

• IndusInd Bank.

• Tata Capital.

• IDFC and others.

If you are interested in a working capital bank loan, a large business loan or a land loan in India, please contact our finance team for advice.

Together with international partners, we will develop a customized financial solution for your project.