After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

The year 2022 witnessed a resilient trajectory despite challenges, with the sector continuing to attract strategic investments.

Cement production reached an estimated 370 million metric tons, underscoring the sector's robustness.

Despite bright market prospects, the pivotal role of competent project financing cannot be overstated. Cement plants demand substantial capital infusion for construction, modernization, and expansion. As traditional sources of funding evolve, the sector has recognized the significance of diversifying financing strategies. Project finance instruments, in particular, offer essential support, enabling companies to access necessary resources efficiently.

Furthermore, the involvement of private investors has proven to be a game-changer. Long-term loans issued by private investors and investment funds bring stability and flexibility to funding schemes.

These investments contribute not only to immediate project needs but also foster sustainable growth, aligning with the sector's long-term goals.

Looking to finance your cement plant project in India?

Our companies specializes in pragmatic financial strategies tailored to your needs. With a proven track record, we offer comprehensive support for constructing, expanding, and modernizing cement plants. Our range of services includes project financing, assistance in obtaining long-term loans from private investors and investment funds, financial engineering, consulting, and more.

The current state of the Indian cement industry

As one of the main engines of a steadily growing economy, the cement industry in India has been one of the most important sectors for many years.India is the second-largest cement producer in the world after China, and the industry plays a crucial role in the country's infrastructure development.

The cement industry in India dates back to 1914 when the first cement plant was set up in Chennai (then Madras). Since then, the industry has grown significantly, with hundreds new large facilities established across the country. The industry witnessed rapid expansion and technical modernization after India's independence in 1947, which led to rapid increase in production capacity.

Last year, local cement plants produced approximately 370 million metric tons of cement of all kinds, leaving far behind such large producers like Vietnam (120 MMT), the United States of America (95 MMT), Turkey (85 MMT), Brazil (65 MMT) and Indonesia (64 MMT). However, India does not compare with the production results of China, which supplies more than 2 billion metric tons of cement annually to the global and domestic markets.

Thanks to low production costs and favourable investment climate, India now hosts more than 8% of the total global installed cement production capacity.

There are more than 200 large cement plants and up to four hundred small production facilities scattered throughout the country.

According to ICRA, India's cement output could exceed 700 million tons by 2027. These figures look quite realistic if global demand continues to be favourable and appropriate measures are taken to stimulate investment. Experts predict that domestic demand will increase by 7-8% in 2024 due to the development of large construction projects and the ongoing economic recovery.

Moreover, in the last four years before the pandemic, Indian clinker and cement exports increased by an average of more than 6,3% annually, as local producers are able to offer competitive products to the world market. The list of the most popular products of local plants includes OPC (Ordinary Portland Cement), hydrophobic Portland cement, PPC, white cement and a number of others.

List of largest cement producers and plants in India

Private companies occupy almost the entire market for cement production in India, and this market is dominated by large corporations.According to rough estimates, the 20 largest companies control almost 3/4 of production. The share of the public sector in this market is negligible.

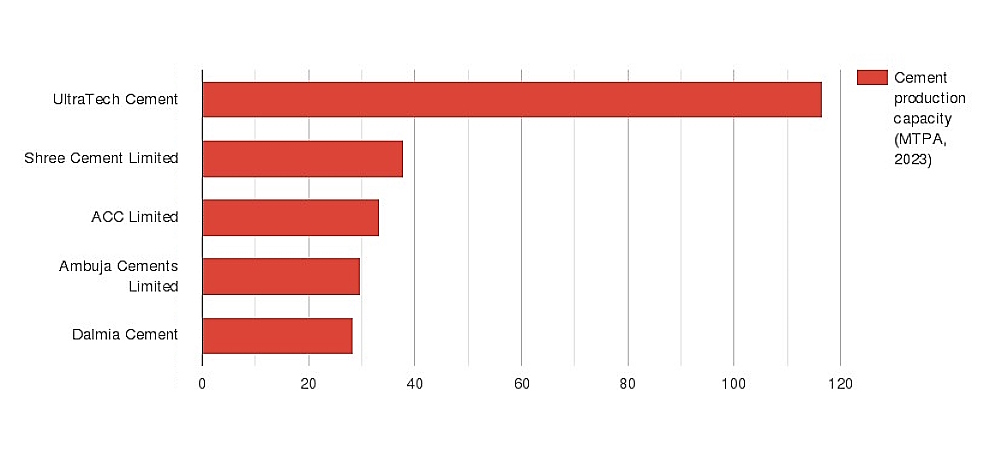

Picture: Top-5 main cement producers in India

The list of the largest cement producers in India is headed by UltraTech Cement Limited, a local company with more than 22 thousand employees and 40 years of history.

In 2022, the company posted an impressive financial performance with revenues of around $8 billion and accounted for almost 21.5% of the Indian cement market. Other major companies include Shree Cement, ACC Limited, Dalmia Cement (Bharat), Birla Corporation, Ramco Cements, India Cements and others. However, the top-5 largest producers in the last year held about 45% of the domestic market.

Table: Key information about the largest cement producers in India.

| Company | Owner | Year of foundation | HQ | Number of employees | Production capacity, MTPA | Domestic market share, % |

| UltraTech Cement | Aditya Birla | 1983 | Mumbai | 22000 | 116,7 | 21,5 |

| Shree Cement | Benu Gopal Bangur | 1979 | Kolkata | 6200 | 37,9 | 6,9 |

| ACC Limited | Associated Cement Companies | 1936 | Mumbai | 6600 | 33,4 | 6,1 |

| Ambuja Cements | Lafarge Holcim | 1983 | Mumbai | 4600 | 29,6 | 5,4 |

| Dalmia Cement Bharat | Puneet Dalmia | 1939 | New Delhi | 6400 | 28,5 | 5,2 |

| Ramco Cement | Ramco Group | 1961 | Chennai | 3400 | 16,5 | 3,0 |

| Birla Corporation | M.P Birla Group | 1910 | Kolkata | 7400 | 15,5 | 2,8 |

| India Cements | N. Srinivasan | 1946 | Chennai | 3000 | 15,4 | 2,8 |

| JSW Cement | JSW Group | 2009 | Mumbai | 1800 | 14,0 | 2,6 |

| JK Cement | J.K. Organisation | 1974 | Kanpur | 3700 | 14,0 | 2,5 |

Modern Indian cement industry includes hundreds of facilities that vary in their size and production capacity, ranging from small units to large bulk terminals and integrated industrial complexes.

Some of the states with the highest concentration of cement companies include Andhra Pradesh, Tamil Nadu, Rajasthan, Karnataka, and Gujarat. The growing demand for cement is tied to the growth of the civil construction and infrastructure sectors, which have been expanding due to rapid urbanization, industrialization, and extensive government initiatives.

The future prospects of the cement industry investments in India appear positive, primarily driven by factors such as government infrastructure investments, urbanization, and a growing population.

The "Housing for All" and "Smart Cities" initiatives launched by the Indian government are expected to fuel the demand for cement in the coming years. Additionally, the push for sustainable construction and green building materials is likely to influence the industry's direction, leading to the adoption of eco-friendly cement production practices.

Financing the construction of cement plants in India

Financing the construction of cement plants typically involves a combination of sources, including equity, debt, and internal funds.The process of securing financing for cement plant construction is similar to financing for large-scale infrastructure projects.

Equity financing

Cement companies in India often attract capital by selling shares or equity stakes in their company. Institutional investors, private equity firms, and individual investors may participate in this process. The equity financing provides the initial capital required for project development.Debt financing

Debt financing (lending) involves borrowing money from various sources to fund the construction of cement plants. This can include loans from banks, financial institutions, and bonds issued in the capital markets. The debt is typically repaid over a specified period with interest.Internal funds

Many of existing cement companies in India use their own retained earnings and internal funds to finance expansion or new cement plant construction. This approach reduces the reliance on external financing and minimizes the impact on existing shareholders.Project Finance (PF)

Project finance is a specialized form of financing where the project itself serves as collateral for the loans. In this structure, lenders assess the feasibility and potential cash flows of the specific project to determine the loan terms. If the cement plant generates expected returns, lenders are repaid from the project's cash flows.

Joint ventures and partnerships

Cement companies might form joint ventures or partnerships with other companies or investors to share the financial burden of constructing new plants in India and other countries across the region. This can also bring in expertise and resources from multiple parties.Government subsidies and incentives

In some cases, central and local governments might provide subsidies, tax incentives, or grants to encourage infrastructure development, including cement production facilities and terminals. These incentives can help reduce the overall project costs and make financing more feasible.International financial institutions

International financial institutions such as the World Bank, Asian Development Bank, and others might provide financing for important projects in developing countries like India. These institutions often prioritize projects that contribute to economic growth and sustainable development.Commercial banks and financial institutions

Commercial banks and financial institutions (some of them are listed below) offer various types of loans, including project loans, working capital loans, and trade finance instruments, to support the construction and operation of cement plants in India.Export Credit Agencies (ECAs)

Financing of many advanced cement projects in India is carried out with the active use of leasing instruments and flexible loans issued by manufacturers of foreign equipment (kilns, grinding mills, crushers, conveyors, and environmental control systems like electrostatic precipitators and baghouses). ECAs provide financial support to companies involved in international trade and investment. They might offer financing, insurance, and guarantees to companies exporting equipment, machinery, or services related to cement plant construction.Public-Private Partnerships (PPPs)

Some cement plant projects in India might be developed under PPP models, where the public and private sectors collaborate to fund and manage the project. The government might provide the land and regulatory support, while private companies bring in financing and expertise.The specific financing structure can vary greatly based on factors such as the size of the cement plant, the location, the company's financial health, and prevailing market conditions. It's essential for cement companies to conduct thorough feasibility studies, financial projections, and risk assessments before seeking financing.

Indian banks involved in financing of cement plants

The cement industry in India has historically been a significant borrower from local banks to fund its expansion and modernization.Indian banks, both public and private sector, have provided a wide range of loans and project finance instruments to cement industry. These funds are used for setting up new plants, capacity expansion, working capital replenishment, and other needs.

Table: Some of the prominent Indian banks that have been involved in financing cement plants

| Bank name |

Market capitalization, $ billion (2023) |

Short description |

| State Bank of India | 62,50 | SBI is one of the largest public sector banks in India. It has been involved in financing various sectors, including infrastructure and cement. SBI's project financing divisions have historically played a crucial role in providing financial support to large-scale industrial projects. |

| ICICI Bank | 82,39 | ICICI Bank is a private bank that has been actively involved in project financing and providing long-term solutions for various industries, including cement sector. It also offers loans and financial products for infrastructure development. |

| Axis Bank | 35,32 | Another large private sector bank, Axis Bank, has been known for providing project financing and working capital solutions to companies in the infrastructure, civil construction and cement sectors. |

| Bank of Baroda | 11,93 | Bank of Baroda is a public sector bank that has offered project financing schemes and corporate banking services to companies in the cement industry. |

| IDBI Bank | 8,39 | IDBI Bank, previously known as a development finance institution and now a public sector bank, has historically been involved in financing infrastructure, construction and industrial projects, including cement plants. |

| Punjab National Bank | 8,06 | PNB is one of the oldest public sector banks in India and has participated in financing various infrastructure projects, including those in the cement sector. |

| Canara Bank | 7,28 | Canara Bank is a prominent public sector bank that has been involved in supporting the development of industry in India. |

It's important to note that banks' involvement in financing cement production projects vary significantly and may depend on factors such as the bank's strategic focus, market conditions, and regulatory changes.

Additionally, different banks in India might have collaborated with specific cement companies or projects, but obtaining exact numbers and brand details can be challenging due to the dynamic nature of the financial sector.

Investments in the modernization of Indian cement plants

Modernization of Indian cement plants has been an ongoing process to improve efficiency, reduce environmental impact, and enhance production capacity.Several large cement companies in India have invested in advanced technologies and equipment to achieve these goals. However, the current modernization trends also cover organizational measures, including an increase in the efficiency of production process management.

The Indian cement industry faces several challenges and issues that have impacted its growth.

Firstly, stringent environmental regulations require cement plants to adopt cleaner technologies and reduce emissions.

Secondly, the sector faces challenges related to energy costs and availability. Modernization and adoption of energy-efficient technologies are crucial to address these issues.

Finally, poor infrastructure and transportation bottlenecks can hinder supply chains.

The following are some important areas of cement plant modernization in India:

• Alternative Fuels and Raw Materials (AFR). Many Indian cement plants have adopted the use of alternative fuels and raw materials, such as waste-derived fuels, biomass, and fly ash, to reduce reliance on traditional fossil fuels and decrease carbon emissions.

• Energy efficiency improvements. Modernization efforts often focus on improving energy efficiency through measures like waste heat recovery systems, efficient kiln designs, and advanced process control systems.

• Production automation and digitalization. Automation and digital solutions help optimize plant operations, reduce downtime, and enhance overall efficiency.

• Green cement technologies. Some companies are investing in research and development of green cement technologies that have lower carbon emissions and use sustainable materials.

• Environmental control systems. Installation of advanced pollution control systems like electrostatic precipitators, bag filters, and flue gas desulfurization units to comply with environmental regulations.

While many cement companies are actively investing in modernization, there can still be a technology gap between leading global practices and those adopted by some Indian cement manufacturers.

The government and the cement industry itself have been taking steps to address many of these challenges through initiatives like the "National Action Plan for Climate Change," promoting sustainable practices, investing in research and development, and encouraging collaborations among industry stakeholders.

Private investment funds and loans issued by private investors play a significant role in financing projects like cement plants. In the context of the Indian cement industry, private investment funds and loans from private investors can provide crucial financial support for construction, expansion, modernization, and other capital expenditure needs.

Table: Benefits and challenges of loans from private investors for the cement industry

| Main benefits | Challenges and concentrations |

| Access to capital: private investment funds offer an additional source of capital beyond traditional bank loans and public markets. | Risk and returns: private investment funds and loans often involve higher risk compared to traditional financing sources. Investors seek higher returns to compensate for the risk. |

| Flexibility: private investors can offer more flexible terms compared to traditional lenders, allowing companies to tailor financing arrangements to their specific needs. | Due diligence: both investors and cement companies need to conduct thorough due diligence to assess the viability of the investment or loan. |

| Expertise and networks: some private investors bring industry expertise, strategic insights, and valuable connections to the companies. | Exit strategy challenges: private investors and investment funds typically have exit strategies in place, such as selling their stakes to other investors or through an initial public offering. |

| Alignment of interests: private investors often have a vested interest in the success of the project, aligning their goals with the company's long-term growth. |

If you are seeking financing solutions for cement plants in India or other countries, our team is here to assist you. We offer long-term investment loans as well as project finance solutions and consulting services.

Our tailored approach ensures that your financing needs are met effectively, allowing you to develop new projects with confidence.