After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

The main ones include the cost of the project, the availability of alternative investment opportunities, limited financial resources, investment risk, profit and payback period of projects.

There are several questions about the purpose and effectiveness of investments, in particular:

• What is the goal of the project?

• What impact will the project have on the current and future activities of the participants?

• How will the organizational structure of the business change?

• How quickly will the project targets be achieved?

• Does the company have the experience to realize the opportunities created by the project?

• What resources are needed for the success of the project?

• What are the possible risks and opportunities to reduce them?

In addition to providing clear and reasonable answers to each of the listed questions, participants must conduct a comprehensive assessment of the planned project and select the most appropriate alternatives.

Comparison and selection of investment projects are carried out on the basis of advanced financial, marketing, management and other methods.

The choice of the investment option in each specific case is a sequence of the following tasks:

1. Choosing the optimal project criteria: profit, profitability, project cost, need for borrowed funds, market share, payback period, etc.

2. Mathematical assessment of the goals of the investment project, the chances of achieving them, risks and adverse conditions.

3. Choosing the most appropriate method for comparing investment alternatives.

4. Establishment of a range of optimal solutions, taking into account the initial data and the requirements of the participants.

5. Selection of the solution recommended from the optimal range.

A successful choice of an investment object in a rapidly changing market environment requires appropriate marketing research, the results of which should form the basis of both the development of a company's investment strategy and the choice of a specific investment instrument.

The most important criterion for choosing the optimal investment solution is the economic effect.

In investment engineering, preference is usually given to such indicators as unit costs, an integral indicator of quality, total costs per unit of production, economic efficiency of investments, market criteria such as the rate of return, growth rates of production and profit. It should be noted that the weight of the analyzed parameters can essentially depend on the type of project, sector or market.

The process of making a decision on long-term investments includes the following steps:

1. Project planning and development.

2. Analysis of costs and expected profit of the project.

3. Assessing the advantages and disadvantages of an investment.

4. Selection of the most appropriate project for implementation.

ESFC Investment Group, a Spanish company with international experience, provides a wide range of investment engineering services, financial modeling services, guarantees, project finance, etc.

Our services are available in Europe and North America, the Middle East and Latin America, Australia and Asia.

Experience, coupled with advanced technologies, allows us to provide our clients with the best quality financial services.

Comparison of investment projects: a modern approach

The basis for comparing the profitability of various projects and investments for the specified period is the present value, which means the value of future revenues or income adjusted for the discount rate.This is the most important indicator that is taken into account.

The discount rate is applied to determine the present value of future payments, taking into account the risk associated with the time. Discounting adjusts future cash flows to determine their present value. Modern methods of comparing investment projects take into account the discount rate.

Modern methods of evaluating investment projects, which are widely used in the practice of developed countries, are based on discounting cash flows.

They include two components:

• Investment costs: the amount of funds invested in a particular project.

• Project results: cash flows including net income and depreciation over the project life.

To assess the effectiveness of investment activities (projects), the scientific literature offers a huge number of methods, indicators, interpreted and calculated differently by different authors.

Among the many approaches, four main methods of estimating investments that take into account the time factor can be traced:

1. Net present value (NPV) method.

2. Method based on the index of return on investment (IR).

3. Method based on the internal rate of return (IRR).

4. Method based on the project payback period (T0).

To compare investment alternatives, all project parameters are reduced to one period using discounting methods. As a rule, future cash flows are discounted to the present value. By comparing discounted cash flow with investment costs, the finance team can obtain a system of more accurate indicators that characterize the effect of investments, payback period and rate of efficiency.

Some investment engineering approaches applicable to planned economies

Among the traditional indicators, the efficiency factor (the ratio of the average annual profit to capital investment) and the payback period are most widely used.Despite the simplicity, both of these indicators have some disadvantages listed below.

First, they do not take into account the time factor. As a result, when calculating both the efficiency factor and the payback period, investment proposals are compared in terms of disparate values, namely the amount of invested funds in present value and expected profit in future value.

Given that the time gap between investing funds and receiving future benefits can be significant, such a comparison can be affected by inflation and other types of investment risk.

Secondly, the disadvantage of these traditional methods for calculating the efficiency of capital investments is that the main criterion for the return to the investor of invested capital is taken only profit. The outdated interpretation of the concept of “depreciation” as a way of accumulating funds for the future reproduction of depreciated assets did not allow depreciation deductions to be attributed to the cash flow. In today's market environment, depreciation is regarded as a way to return on invested capital.

Together with net income, it is the source of future cash flows.

Some authors continue to defend the comparison of investment projects according to traditional methods, based on minimizing costs or maximizing profits. This approach was highly dependent on standard factors, which were determined empirically and did not always reflect the real situation.

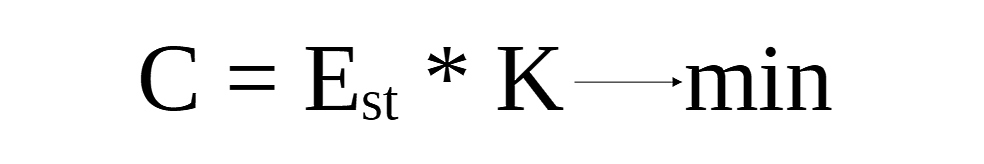

The concept of cost minimization looked like this:

C – current project costs;

K – capital investments;

Est – standard factor.

In countries with planned economies, this approach has long been the basis for assessing the effectiveness of investment decisions.

Given the standard efficiency factors for the introduction of new technology, projects with minimal initial and ongoing costs were considered more attractive.

This system for comparing investment alternatives was based on the options with the least resource requirements. It worked well in a centralized economy, when the owner was one subject, the state. In a market environment, the minimum cost of a project can no longer be considered as the basis for choosing the most suitable investment options.

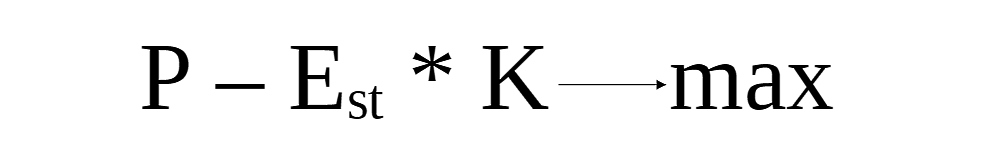

In investment engineering, attempts have been made to assess the effectiveness of investments using methods focused on identifying investment options with the highest profit.

The concept of project profit maximization is given below:

P – project profit;

K – capital investments;

Est – standard factor.

When conducting a comparative analysis of several projects of various scales, it was proposed to calculate the minimum costs through standard coefficients of specific costs and capital investments.

All these approaches have the same shortcomings. They do not take into account the factor of time, cash flow, and are also based on limited information. In addition, the main principle of the optimal ratio of results and costs is not observed when determining the effectiveness of the project.

Let's go back to modern methods for evaluating investment projects and consider in more detail the key indicators used in the practice of investment engineering, such as NPV, IRR and others.

Net present value method

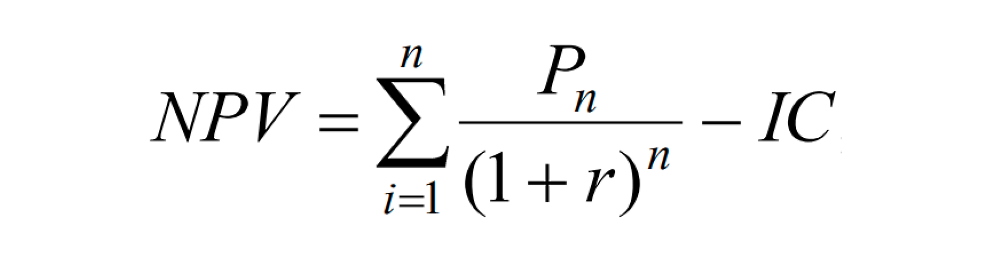

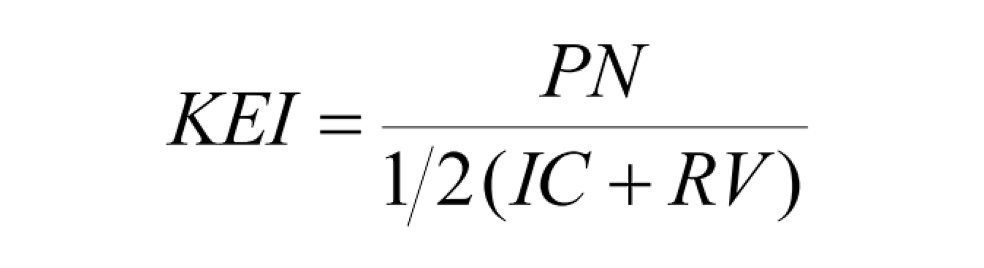

Many experts place a lot of emphasis on the so-called investment performance ratio (KEI), but the central component of evaluating investment performance is the net present value (NPV) calculation:

Pn – project cash flow over n years;

IC – the amount of the initial investment;

r – discount rate.

So, the net present value is the difference between the cash flows received during the operation of the project, discounted at an acceptable rate of return and the amount of investment.

When evaluating investment alternatives, the following should be kept in mind:

• If NPV>0, the investment will be profitable and the project can be accepted.

• If NPV<0, the investment will be unprofitable and the project should not be accepted.

• If NPV=0, the investment will give neither profit nor loss.

In the latter case, the final investment decision should be made on the basis of other criteria (improvement of the environment, improvement of the company's reputation, achievement of a certain social effect, and so on). If the company has several projects, then it should focus on the project with the highest NPV value.

The net present value method is often regarded as the most acceptable approach to capital investment assessment and comparison.

The advantages of the method include the fact that the net present value shows the probable increase in the capital of the enterprise in case of successful implementation of the investment project. Since the main goal of managing a company is to increase its capital, this approach is consistent with the needs and challenges that management faces.

A significant advantage of the NPV method is its additivity, which refers to the addition of net present values for different projects in order to analyze the total amount of capital gains. It should be noted that the net present value is used in many different methods of investment engineering.

At the same time, the method does not allow evaluating the effectiveness of the project in terms of costs / benefits. As a result, the company may choose not the most profitable project, although generating significant income, but also requiring significant initial investment.

The net present value method is most appropriate when investment resources are practically unlimited, and a stable economic situation allows fairly accurate forecasting of the rate of return for a long period. It should be noted that when calculating NPV, the financial team does not always get the right idea about the cost-effectiveness of investments.

Return on investment index

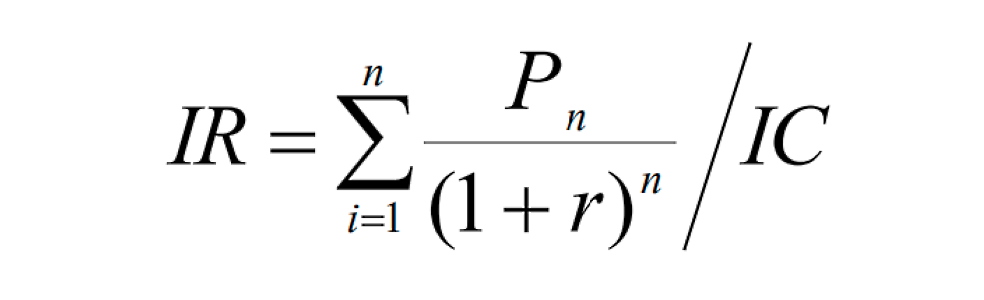

The index of return on investment (IR) determines the degree of profitability of a unit of costs. It is calculated on the basis of the net present value and the initial investment amount.This indicator is also of great importance for comparing investment projects and choosing the best alternatives.

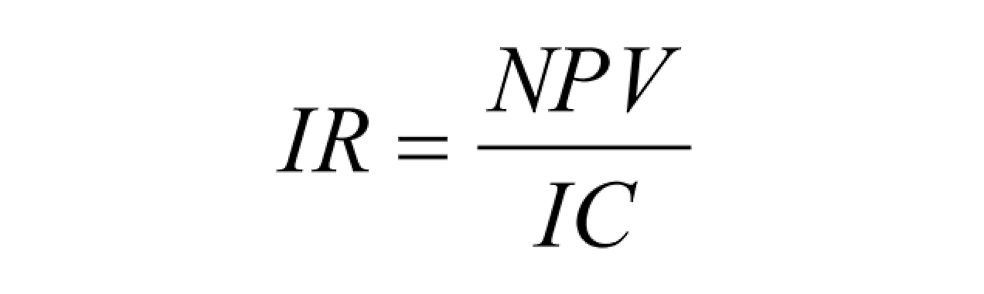

In other words, the index of return on investment can be calculated as follows:

From the above formula, the following conclusions can be drawn:

• If IR>1, the investment is profitable;

• If IR<1, investments are considered unprofitable;

• If IR=1, the investment is neither unprofitable nor profitable.

Therefore, an investment project is justified only if its profitability is higher than 1.

The index of return on investment can be used when choosing a project from among alternative options when the net present value has approximately the same values, or when the financial team is forming an investment portfolio with a maximum total net present value.

Internal rate of return

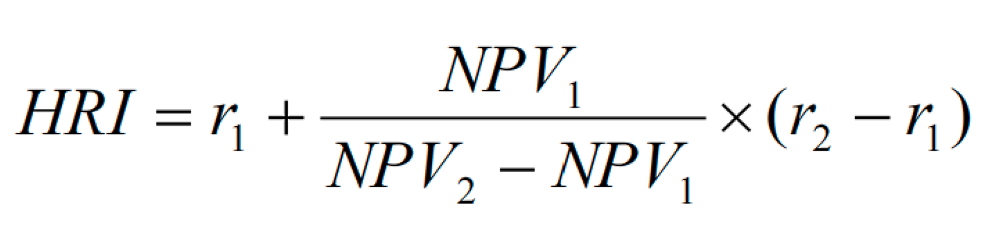

The internal rate of return (IRR, HRI) is the value of the discount factor at which the net present value of the project is 0. If a company takes a long-term loan from at 25% in two years, then it must invest it in a project that provides positive net present value at discount factor of 25% over 2 years.The internal rate of return is important in the process of determining the sources of financing for an investment project.

Comparison of the cost of invested funds, that is, the cost of using bank loans, dividends and other costs associated with attracting financial resources, with the real IRR of the project allows the financial team to determine its feasibility and make an informed decision.

If the internal rate of return of the project is higher than the cost of attracted capital, then the project is considered profitable, and the difference between these values shows the level of profitability that the investor can expect.

If the internal rate of return is equal to the cost of capital, then the project does not generate income. Then the choice of investment alternative should be based on additional criteria, for example, taking into account the social or environmental impact. If the IRR is below the cost of capital, the project is economically unviable from any point of view.

The following formula is used when calculating the IRR, when cash flow is not a constant value:

r1 – discount rate value at which NPV1 is greater than 0;

r2 – discount rate value at which NPV1 is less than 0.

As for the comparison of investment projects. Projects can be ranked in descending order of the internal rate of return of two incompatible projects.

Obviously, preference should be given to the project in which the IRR exceeds the discount rate.

The investment payback period and project efficiency

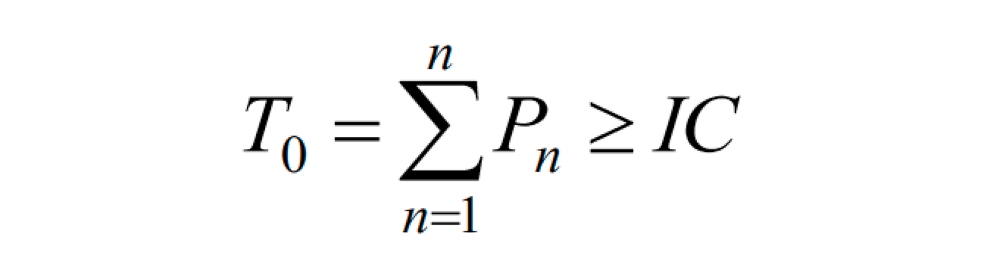

The investment payback period (T0) is the time during which the cash flow received by the investor during the operation of the project equals the amount of invested funds (it is usually measured in years, months).The investment payback period can be calculated using the following formula:

Pn – project cash flow over n years;

IC – the amount of the initial investment.

To determine the payback period, the volume of investments is compared with the cash flows from the project. The period at which the cash flow compares with the amount of investment will actually be the payback period.

If the cash flow is stable during the life of the project, then the payback period can be calculated by dividing the investment by the annual cash flow. When determining the payback period of investments, the discounting technique is not applied. When comparing several investment projects, the one that has a shorter payback period is considered more attractive.

The investment efficiency ratio refers to the level of profitability of the investment project without taking into account income discounting.

This ratio calculated is based on a comparison of net profit and initial investment according to the following formula:

PN – profit over the life of the project;

RV – residual value of the equipment.

It is rather difficult to assess the effectiveness of real investment projects with a long payback period, since the calculation of investment parameters is based on the concept of estimating the cost of funds over time. Investors mainly proceed from the advantage of the current value of money, since in this case there is a risk of non-return in the future of the funds invested in the project.

When analyzing alternative projects, the calculated indicators of NPV, IRR can give a contradictory assessment, i.e. a project accepted for one indicator is considered inappropriate for another indicator. In this case, priority is given to the project with the higher net present value.

In highly competitive market conditions, an important criterion for the effectiveness of an investment project is the level of return on invested capital.

The concept of project profitability is understood as the rate of capital growth, which fully compensates for changes in the purchasing power of money over a certain period, ensures the accepted level of profitability of the project and covers the risk of the investor associated with its implementation.

Therefore, the problem of choosing investment alternatives for an investor is largely a matter of comparing returns.