Investment strategy development services

ESFC Investment Group offers:

• Investment financing from €50 million and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Loan guarantees

ESFC Investment Group, an international company headquartered in Spain, has brought together experienced experts in the field of financial modeling, investment engineering and consulting.

We are ready to provide you with a full range of financial services for large businesses in the European Union and the United States, as well as in East Asia, the Middle East, Latin America and other regions of the world.

If you are looking for affordable sources of long-term financing for large projects, ESFC offers loans from 50 million euros with maturities up to 20 years.

We also organize project finance (PF) schemes with a minimum contribution of the initiator from 10% of the project cost.

Principles, factors and stages of investment strategy development

Large investments, which are the driving force behind the development of the global economy, mean long-term investment of capital for profit.A set of measures for the implementation of investments is called an investment strategy.

The investment strategy of an enterprise is often considered as a system of long-term goals and objectives of investment activity, as well as the tools and mechanisms to achieve them. The main task of any company in the development of an investment strategy is to find and provide the effective ways to implement investment projects or their parts.

The investment strategy of a large business can take two forms:

• Active strategy: growth of the business based on the implementation of development projects, involving active investment in new projects, expansion and modernization of existing assets.

• Passive strategy: investments are aimed at maintaining the existing production level (usually associated with a deteriorating economy and contraction of markets, as well as a decrease in the availability of capital).

The process of developing an investment strategy involves studying the existing potential of the enterprise and determining its ability to function effectively in the external environment, which allows you to reasonably set goals and determine the objectives of innovative business development. This should become the foundation for successful investment activity.

In this context, it is important for management to compare a range of alternatives, selecting promising investment projects based on their risk and potential profitability under expected conditions. Comparison of alternatives in the process of developing an investment strategy should take into account the key phases of the life cycle, which will allow the finance team to consider the main risks associated with each of the projects.

Thus, a correctly defined strategy allows companies to form an investment portfolio that is optimal for specific conditions, which in practice will help improve business efficiency and create prerequisites for the company's sustainable growth in a certain time horizon.

Investment strategy management principles

Large business differs from SMEs, first of all, in the complexity and multi-vector nature of the decisions made.Investment in this case requires a deeper and more comprehensive analysis, given the complex contractual structure, the close relationship of any enterprise with related sectors and a high level of uncertainty.

Below we have listed some principles that should be considered by the companies in the development and management of an investment strategy.

Table: Principles for developing an investment strategy for a business.

| Principles | Brief description |

| Consistency | The investment strategy consists of many narrow areas determined by the designated areas of the company's investment activities, and its development and implementation should be carried out in the context of the relationship between strategic goals, tactical and operational business objectives. |

| Adaptability | Ensuring effective adaptation of the investment strategy to changes in the factors of the external environment of the enterprise; any strategic changes in investment activities should be predictable and prompt response to relevant market and economic changes. |

| Natural selection | The development and comparison of available investment projects is carried out in order to select the most suitable solution in terms of the ratio of potential financial efficiency, costs and risks for the company. |

| Profitability | The cost of invested resources should not exceed the expected economic effect of the investment project. |

| Continuity | The investment strategy management process is continuous; if the chosen strategy does not produce the desired results, it must be replaced by a stronger strategy. |

| Purposefulness | The implementation of the business investment strategy should ensure the achievement of clearly defined and justified business goals. |

| Legality | The implementation of the measures provided for by the investment strategy is carried out in compliance with the current legislation. |

| Synergy | The implementation of a set of measures that make up the overall investment strategy should provide a greater effect on business activities than individual measures. |

Investment strategy selection factors

Being the main action plan of any business, the investment strategy should determine the priority areas, methods and forms of investment, the nature of the formation of investment resources and the sequence of stages in the achieving of investment goals.This should be based on the correct analysis of external and internal factors, the competent setting of goals at different time intervals and the rational distribution of financial and other business resources.

Investment strategy selection factors include the following:

• Expected rate of return.

• Investment horizon (planning period).

• The economic health of the company, as well as its partners.

• The level of management knowledge and their business experience.

• The willingness of stakeholders to take risks.

• Access to financial resources (credits).

• Market situation etc.

The choice of an investment strategy should always be considered in close connection with a number of external and internal factors of business activity, including production, financial, personnel, marketing, environmental and others.

This activity should be carried out in the context of a comprehensive in-depth analysis of the investment climate both in the country and in a particular industry. Thus, it is a multi-level process that includes an assessment of the macroeconomic and microeconomic aspects of the business.

Stages of developing an investment strategy

Any investment involves reducing or abandoning current consumption in favor of future, albeit uncertain, benefits.The purpose of the investment strategy is to achieve the highest possible rate of return with an acceptable level of risk, which largely determines the further actions of management.

The process of forming an investment strategy includes the following:

1. Determining the object of study, setting specific goals and objectives of investment analysis, as well as drawing up a plan for analytical work.

2. Formation of a system of indicators to characterize the object of analysis (for example, a set of parameters for comparing alternative projects).

3. Collection, training and analysis of the necessary information using advanced quantitative and qualitative methods of analysis.

4. Establishing the relationship and the level of influence of factors based on the results of the investment activities of a particular company or its division.

5. Search for unused and promising reserves in order to increase the efficiency of investments and the company's investment activity.

6. Preparation of conclusions and recommendations based on the results of the work done.

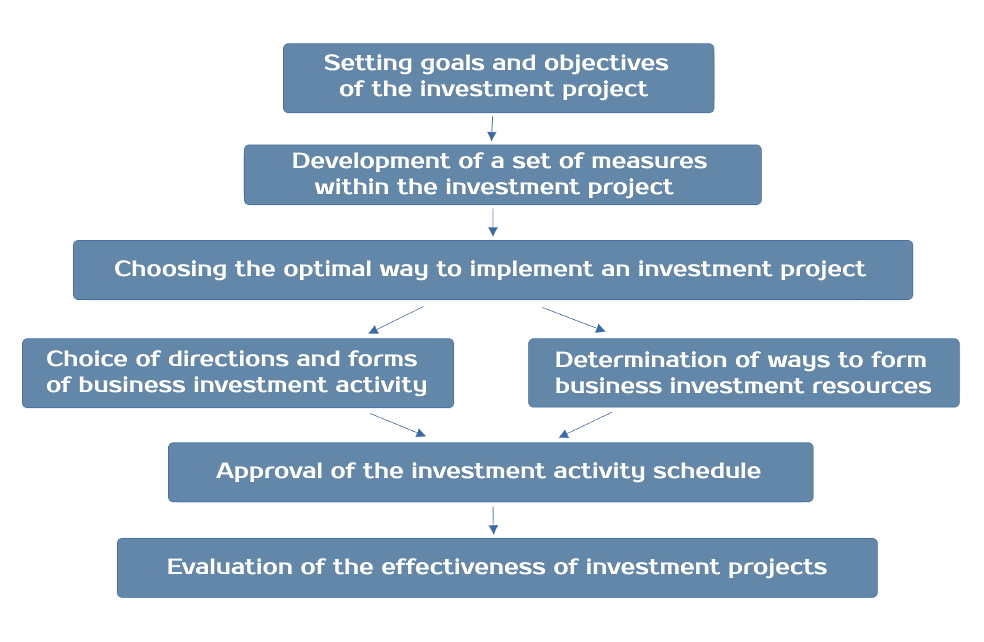

Obviously, the successful achievement of business goals is inextricably linked with the so-called investment design. In the figure below, we propose a simplified model.

Figure: Stages of investment design.

Fundamental analysis for choosing an investment strategy

Fundamental analysis of securities, companies or projects in a broad sense is an assessment of the real value of a potential investment object through related economic and financial factors of various levels. The basic information used in fundamental analysis is information about the economy and the market, as well as all available financial information about a company or project.The components of fundamental analysis are listed below:

• Macroeconomic analysis.

• Sectoral analysis.

• Situational analysis.

• Financial analysis.

Below we will consider in detail the components of fundamental analysis and clearly demonstrate their role in the development of an investment strategy for a large business.

Macroeconomic analysis

Macroeconomic analysis is based on a professional assessment of the attractiveness of investing in a particular market, primarily the stock market.The level of attractiveness depends on the economic, political and social situation, economic policy and investment risk of the host country.

Macroeconomic analysis is based on key macroeconomic parameters that generate positive and / or negative signals for the investor and largely determine the decision to invest in a particular project.

Table: Positive and negative macroeconomic signals for the investor.

| Factor | Positive signal | Negative signal |

| GDP growth rate | High | Low |

| Inflation rate | Low | High |

| Host country budget deficit | Low | High |

| State debt | Low | High |

| Unemployment rate | Low | High |

| Central bank interest rates | Low | High |

| The level of tax burden | Low | High |

| Government intervention | Low | High |

| The role of trade unions | Low | High |

| Labor market flexibility | High | Low |

The above are just a few examples of macroeconomic factors that can influence the formation and management of a business's investment strategy.

These factors can be supplemented, for example, by the factor of political stability, sanctions, military risks, and so on.

In any case, it is critical that the investor does not make decisions based only on single signals.

A well-balanced strategy should be based on a comprehensive analysis.

Analysis of a specific industry

Sectoral analysis usually consists in assessing the investment attractiveness of companies belonging to a particular industry.First of all, financial experts take into account the efficiency of doing business and the level of risk in this sector.

The sensitivity of the sector to changing economic conditions is also an important parameter. Obviously, in the event of an economic downturn, companies should not invest heavily in sectors that are sensitive to economic changes.

A vivid illustration can be the deplorable situation in the restaurant business and tourism, which was observed around the world at the height of the pandemic. On the other hand, unexpected restrictions have led to a sudden exponential growth of the IT sector.

Company situational analysis

The situational analysis concerns the specific company under consideration, taking into account, first of all, criteria that are not directly related to the situation of this company.The content of this analysis largely depends on the type of activity (manufacturing, trading or financial companies).

The following is an example of a situational analysis of a manufacturing plant:

• Product: age of the product, range and potential for future diversification, likelihood of a substitute product, exposure of a particular product to uncertain market factors.

• Suppliers: the impact of suppliers of raw materials, energy and materials on business; the possibility of diversifying supplies and changing prices.

• Buyers: the circle of buyers, their behavior and influence on the development of the company.

• Market: barriers to entry in the market in which the company is located, competition in that market, and the relative size of the company in the market.

• External environment: economic and political stability in importing countries; volatility of product prices on world markets; volatility of exchange rates in which trading operations are carried out.

• Personnel: qualification of the company's employees, linking wages to the results of work, support for the training of company employees, the attitude of employees to business development.

• Management: knowledge, experience and skills of company management, adequate organizational strategy for management and business development.

• Technologies: the level of technologies used and their interchangeability.

In order to properly develop a business investment strategy, it is important to take into account the current position of the company relative to competitors and its development prospects in a certain time horizon.

Company financial analysis

Business financial analysis as a part of fundamental analysis has been used in commercial practice since the middle of the 20th century and continues to play a key role in choosing an investment strategy and making strategic business decisions.Along with an assessment of external factors such as the state of the economy, a detailed financial analysis of the company issuing shares or other financial instrument allows a potential investor to make the right decision. The better the financial condition of the issuer, the higher the value of the shares and the more attractive they are for the investor.

The main sources of information about a company are its financial statements and other financial data available on the modern capital market.

The financial statements used in the development of an investment strategy include the following:

• Balance sheet.

• Detailed income statement.

• Cash flow statements.

• Report on changes in the structure of assets.

• Other financial indicators and information.

Financial analysis of a company or project is usually carried out using a certain set of indicators, so this part of fundamental analysis is called ratio analysis.

This group includes the so-called debt ratios, liquidity ratios, profitability ratios, etc.

Liquidity ratios measure a company's ability to pay current liabilities. Debt ratios analyze a company's long-term debt, more specifically, the size of a company's debt and the company's ability to service that debt. Profitability ratios show the ratio of a company's profit to other indicators.

Development of an investment strategy for large businesses: our services

The essence of investment engineering looks simple and clear, however, the correct application and interpretation of each indicator and each model will require practical financial experience.For these reasons, the development of an investment strategy requires the involvement of external experts.

Experienced teams that specialize in investment services increase the chance of success.

ESFC Investment Group, a Spanish financial company with extensive international experience, is engaged in long-term financing of large projects and the organization of project finance (PF) in industry, energy, infrastructure, agricultural business, mining and other sectors.

We provide clients with a full range of services for large businesses:

• Long-term loans for up to 20 years.

• Organization of project finance (PF) schemes.

• Operations with letters of credit or bank guarantees.

• Financial modeling and consulting.

• Investment engineering.

ESFC, in cooperation with major international partners, can contribute to the implementation of investment projects based on EPC contracts.

The services of a general contractor can be useful in the construction, modernization and expansion of capital-intensive facilities (factories, mines, refineries, LNG terminals, power plants, water treatment plants, gas pipelines, roads, real estate, etc.)

Learn more about the benefits of modern engineering and financial tools for your business.