After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

A brief analysis of the capital expenditures of the top 100 largest mining projects of the last decade shows a range of CapEx from 200 million euros to several billion, where from 10 to 90% of all expenses are attributable to initial expenses. Mine construction cost is slightly rising every year as mineral resources are depleted, environmental legislation tightens and labor costs increase.

Choosing the best source of long-term capital can be the key to high profitability and competitiveness of your project.

ESFC Investment Group is a reputable international company headquartered in Spain, which is engaged in long-term financing of large investment projects in the mining and processing of minerals, the energy sector, oil and gas, heavy industry, agriculture, hospitality, construction and tourism.

We offer long-term debt capital for the construction of quarries, mines, mining and processing plants, electrical substations, warehouses, industrial wastewater treatment systems, roads and transport hubs for the mining industry around the world.

If you are looking for funding for a new mining project, please contact our experts anytime.

Average cost of a quarry/mine construction: investment comparison

Eric Louis Kohler, an American accountant, author and scientist, pointed out that any production of goods or services involves "prepayment" and waiting for the delivery of finished goods that must be put up for sale and become sources of income.Thus, investment costs in any economic activity must be incurred long before the revenues corresponding to the sales of goods or services are generated.

In the case of the construction of mines, quarries, processing plants and other mining enterprises, this usually means hundreds of millions of euros of loans and investments that must be attracted many years before the project will generate stable cash flows.

The construction of the mine includes the development of a range of underground elements, above-ground structures and associated infrastructure. The cost of construction and equipping of such facilities depends on the type of mine, the depth of mineral deposits, the type and strength of rocks, the chosen construction technology, the size and shape of the mine, and a number of other factors.

Payback periods for mining projects also vary widely, from 3-4 years to almost a decade. For example, after-tax payback periods for highly productive gold mines are in the order of 3 years at an internal rate of return of 25-35%, while many iron ore mines or coal mines show much more modest economic performance. This should first of all be taken into account when choosing financial instruments for the construction of a mining enterprise.

Any mining project consists of several successive stages that require appropriate costs and funding sources.

These standard stages include the following:

1. Exploration work.

2. Evaluation of reserves and resources of the selected field.

3. Engineering design services and construction work.

4. Purchase and installation of mining and processing equipment.

5. Liquidation of the mine and rehabilitation of the environment.

The most expensive stages of most mining projects are engineering, construction, equipment purchase and commissioning, which together require up to 90% of the total investment cost of the project.

Open pit mining is technically simpler and cheaper in general, although this approach requires the purchase or lease of vast land plots with costly environmental protection measures. If we talk about underground mining, the construction of the underground part accounts for an average of 35 to 60% of the investment costs for equipping and developing the facility. A significant share of the costs is the purchase of equipment, ventilation systems, transportation and storage equipment.

The modern economy relies on minerals ranging from rare earth metals for the electronics industry to titanium and iron for the defense sector.

Mining tends to be of strategic importance to the national economy, so many mines operate in a challenging environment of limited market competition, tax incentives, government support and guarantees. Financing the construction of mines and quarries can be a joint initiative of private business, the government and municipalities.

Estimating the cost of such projects also has a number of features, being largely dependent on the type and estimated reserves of minerals, mining technology and other factors. The life cycle of a mine or quarry is limited by the period of exhaustion of mineral reserves that are economically profitable to extract in a certain area in one way or another.

The cost of building a mining facility can be estimated using the following information:

• Guidelines and standards proposed by experts at national or international level.

• Practical experience and statistics of other enterprises operating in the same mineral field.

• Analysis and comparison of market offers of construction contractors, mining equipment manufacturers and engineering companies.

When looking for sources of financing for a specific project, experts take into account the structure and cost of capital (long-term sources), systemic risks in a particular mining niche, the stage of the deposit’s life cycle (for projects to modernize existing mines and quarries) and other factors. Given the role of mining of iron, polymetallic ores, uranium and other strategic minerals, governments often provide significant financial support for the development of such projects.

In general, most mines and quarries are 50-80% financed by debt capital. However, project sponsors must be prepared to provide some of the capital from their internal resources, especially in the early stages when the economic prospects for the development of the project are unclear.

Approximate cost of copper mines

The cost of building open-pit and underground mines also shows a gradual increase over the years as easily accessible resources are depleted, environmental requirements become more stringent, and the cost of equipment and labor increases.For example, capital costs per ton for some precious metals projects have increased 5-10 times over the past two decades.

Initially, copper was often mined in an open way, but the active exploitation of such deposits has led to the exhaustion of many of them. Obviously, open pit mines are cheaper on average, but as the easily accessible copper ore deposits are exhausted, some projects have to be transformed into deep underground mines that require expensive construction work and high maintenance costs.

But the main factor affecting the cost of a particular mine or quarry is the geological complexity of the project. An example of a technically complex and costly copper investment project is the Cobre Panama project, one of the largest copper mines in Latin America.

This major project was originally financed and developed by the Canadian company Inmet Mining Corporation, but was subsequently sold to First Quantum Minerals Ltd.

The total investment cost of the project was US$6.2 billion, including US$1.36 billion in loans to be repaid with future supplies of gold and silver.

Cobre Panama exploits a large copper deposit with a relatively low metal content averaging 0.38% copper, as well as molybdenum, silver and gold.

The mine is capable of producing up to 85 million tons of rock per year, from which more than 300,000 tons of copper can be extracted along with gold and silver. As we can see, the capital cost of building a mine of this size was about $20,000 for every ton of annual output. The estimated life of the deposit is more than 30 years.

On the other hand, some mines can operate successfully for centuries, even increasing productivity due to the enormous mineral reserves. For example, the El Teniente copper mine in the Chilean Andes actually began operating in the first half of the 19th century.

After massive expansion and a series of upgrades during the 20th century, this mine not only remained one of the largest copper suppliers in the region, but also increased productivity many times over. According to 2006 data, this facility produced more than 400 thousand tons of ore every day. But over this long period, engineers had to move from mining copper near the surface to building underground workings up to 1,900 meters deep.

It cost the owners of the mine (since the 1970s the state-owned Corporación Nacional del Cobre de Chile) billions of dollars and decades of construction work.

An open-pit mining project called the Quebrada Blanca Copper Mine, which is also located in Chile, clearly demonstrates the investment needs of modern projects of this type. The Quebrada Blanca Phase 2 expansion, as of mid-2022, has been valued at around US$7 billion by international partners. The mining project is planned to produce up to 240,000 tons of copper concentrate per year along with molybdenum and other metals, which translates into a capital cost of $29,000 per tonne of output. The reserves are expected to be sufficient for 28-30 years of operation.

Many mines show much lower numbers, which largely depends on the conditions of development of a particular deposit.

For example, the Oyu Tolgoi copper and gold mine in Mongolia has been valued by investors at about $7 billion.

The main owner is the world famous mining corporation Rio Tinto. The peak output is expected to exceed half a million tons. Despite lengthy construction and an increase in the estimated cost compared to initial plans, capital expenditures are expected at $12,000-13,000 per tonne of annual production.

Cost of building coal mines

Capital costs for the construction of coal mines are characterized by a significant spread, which mainly depends on the natural conditions of a particular deposit.Despite the use of modern techniques and cost estimation models, the magnitude of errors varies from 20 to 50% and even more. Unforeseen costs associated with geological difficulties, technical obstacles, breach of contractors' obligations and other factors require the accumulation of sufficient reserves to ensure smooth financing of a coal project with a certain level of deviation from planned costs.

Historical data collected in various coal-producing countries indicate a general upward trend in the cost of building coal mines. In general, the cost of such facilities ranges from 30 to 80 million euros per 1 million tons of coal per year, so the cost of even small projects can easily exceed 100 million euros.

At the same time, surface coal mines are on average 1.5-2 times cheaper compared to underground mining, which requires the construction of deep and technically complex mine shafts thousands of meters deep. The cost of large mines today is approaching 1 billion euros, and we are talking only about capital expenditures at the initial stage of the project (exploration, permitting, construction, equipping and start-up).

Total capital costs play a key role in deciding whether to continue a project, close it, or transform it.

Parametric estimation, often used in the coal industry, requires the expert team to have a wealth of experience and the application of accurate data from similar projects, processed using advanced methods and models.

Along with changes in capital costs, for each investment decision, the potential impact of changing the original design on operating costs once the mine has started operating should be defined, as this is critical for the owner company in the long term.

The results of a coal mine construction cost estimate can be used for a wide range of purposes, including the following:

• Assessment of the viability of the investment project

• Planning a funding strategy and selecting funding sources

• Evaluation and comparison of investment alternatives

• Search for optimal engineering solutions within the project

• Creation of points for project control

The table below summarizes the main elements of capital and operating costs in the construction and operation of coal mines. These elements provide an overview of the factors that should be considered and monitored when planning new mining projects.

Table: Key elements of capital and operating costs in the coal industry.

|

Capital costs

|

Operating costs

|

| Deposit evaluation, search and study of coal reserves available for mining | Payment for land lease |

| Construction of water pipelines and electrical substations, installation of processing equipment, as well as the construction of roads, staff houses and administrative buildings | Taxes and other obligatory payments |

| Development of associated infrastructure, since in some cases large and remote mines require the construction of railway stations, river or sea ports or other expensive logistics facilities. | Recruitment, training and maintenance of staff |

| Cost of obtaining licenses, certificates and permits | Equipment maintenance and repair |

| Costs for the construction of mine shafts and underground workings | Maintaining the safety of underground workings |

| Design, purchase and installation of special equipment | Fuel, electricity and water |

| Costs of environmental protection measures | Maintenance of off-mine infrastructure |

It should be understood that the capital needed for the initial costs needs to be raised in advance so that the activities mentioned in this list can be implemented as quickly as possible.

This will allow the mining project to move to the operational phase, when the mine will actually generate cash flow. At the same time, any project must be planned in such a way as to minimize the so-called off-mine infrastructure costs. In many cases, this is achieved through the close cooperation of mining companies with governments and municipalities, which help businesses build railway stations, roads and ports, for example, through public-private partnerships.

The so-called stay-in-business capital, as its name implies, is necessary for a company to maintain business activity after the launch of a mining project.

These are funds that are spent to pay for land rent, taxes, security, staffing and other measures. Finding sources to pay for these costs is critical in the initial phase of a mine's operation, as sufficient cash flows will be generated much later.

In general, operating costs are divided into fixed costs and variable costs.

Fixed costs do not depend on the productivity of the mine, while the level of variable costs is determined by the amount of coal mined (for example, the cost of blasting in open pit mines, the cost of fuel, spare parts for drilling equipment, electricity and water).

These costs will largely depend on the type of mine, the technology and drilling methods used (for example, room-and-pillar mining or longwall mining), host country legal requirements, and many other factors. All this requires reliable funding at the initial stages of operation of the mining project.

The cost of mine modernization: how much to invest?

One of the conditions for the survival and successful development of any mining company is effective investment activity, which involves the rational use of financial resources and ensuring profitable extraction, processing and sale of minerals in accordance with the market situation.At the same time, the investment capabilities of the enterprise and the sector are always limited.

There is a contradiction between the financial potential of the enterprise and investment needs, which largely depend on the specifics of the industry, the demand for a specific type of minerals, market demand, prices for energy and other resources, government policy and many other factors.

It is this fine balance between investment needs and financial capabilities that ultimately determines each mining company's approach to mine / quarry modernization.

Most mining projects are long-term investments, with lifespan measured in decades. This significantly exceeds the lifetime of any technology or equipment that can be used at the initial stage of development of such a project.

For example, the lifespan of copper mines reaches 65-70 years, which means that the facility must go through the modernization of the production process at least 3-4 times during its lifespan.

Coal mines and similar facilities face similar challenges as their lifespan increases. With age, the planning of new underground workings becomes much more complicated, the operating conditions become more complicated, and new safety problems arise. In particular, older mines require more sophisticated ore transport systems and more expensive ventilation and fire safety systems.

The cost of modernization of mines can run into the tens of millions of euros when it comes to large technically complex projects in geologically challenging areas.

The unfavorable asset structure also affects the cost of modernization and the ratio between costs and gains in mine efficiency. A significant part of the assets of any old mine is unused underground workings and ancillary structures on the surface, that is, assets that do not bring income. Moreover, abandoned workings create additional safety problems and require significant costs.

In some old coal mines, these assets exceed 75%, which contributes to the low economic efficiency of the mine and increases the cost of the modernization.

In addition, when planning an investment project, it is important to take into account the potential of a particular mine, which cannot always be unlocked by certain engineering measures. It is important for mining companies to strike a balance between investments and the income that a particular mine can potentially bring in the distant future.

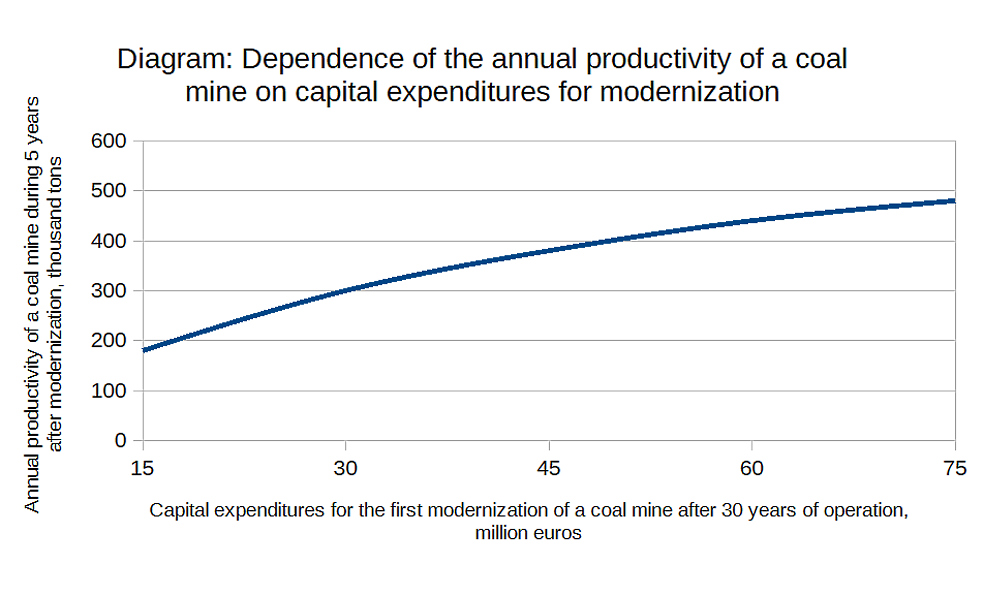

The diagram below shows the relationship between the cost of modernizing an average coal mine and the increase in capacity during the next 5 years after the modernization.

The diagram is based on analysis of data from several old Soviet-era mines in Eastern Europe.

As follows from the above diagram, the increase in the cost of modernizing the mine at a certain point begins to give less and less returns.

Finding the optimal investment solution that takes into account financial, technical, legal and other factors is the key to the success of such projects.

The life of a mine before it is upgraded depends on numerous factors, including the type of mine, the technology initially used, the market situation, the technical level and current productivity of competing mines, the strategic plans of the owner company, and changes in environmental and safety requirements.

For example, the modernization of coal mines in developed countries is usually carried out every 15-20 years, while similar measures in many developing economies are funded every 20-30 years or even less frequently.

The cost of mine modernization is largely determined by the scale of modernization, the initial structure of assets and their age, the goals of modernization and the choice of technologies and specific engineering solutions that correspond to certain tasks. For example, the cost of a modern high-tech ventilation system for a uranium mine can reach 15-20% of the total cost of an investment project.

With an average mine construction cost of 50 million euros, the cost of ventilation system can reach 10 million euros.

Of course, this amount can vary depending on the cost of equipment and construction work, as well as on the personnel safety requirements that apply in a particular country.

Typically, mine and quarry modernization projects cost tens or hundreds of millions. The modernization of a large coal mining system in Uzbekistan in 2014-2016 cost a local company and Chinese funders more than $100 million. This project, designed to produce up to 500 thousand tons of coal per year, took more than two years. These figures give an idea of the scale of capital expenditures that mining companies should expect when planning to upgrade coal mines.

It should be noted the important role of the state and public funds in the modernization of mining projects. The point is not only in the strategic role of mining for the economy, but also in environmental threats that require a comprehensive approach. Thus, insufficient funding for old coal mines (including maintaining the safety of abandoned underground workings) can lead to mine flooding and serious environmental problems.

This was clearly demonstrated in the countries of Eastern Europe after the collapse of the USSR, as well as in Latin America and South Asia.

For this reason, the involvement of governments and municipalities in the modernization of mines and off-mine infrastructure is in many cases critical to the safety and prosperity of entire regions.

If you are looking for flexible financial models for the construction of an iron mine, copper mine, salt mine, rock quarry or other mining project, please contact our team.

We provide comprehensive project finance services along with financial engineering, modeling and consulting services.